The brand visibility platform for mortgage

Put your loan officers at the top of every search

Put your loan officers at the top of every search

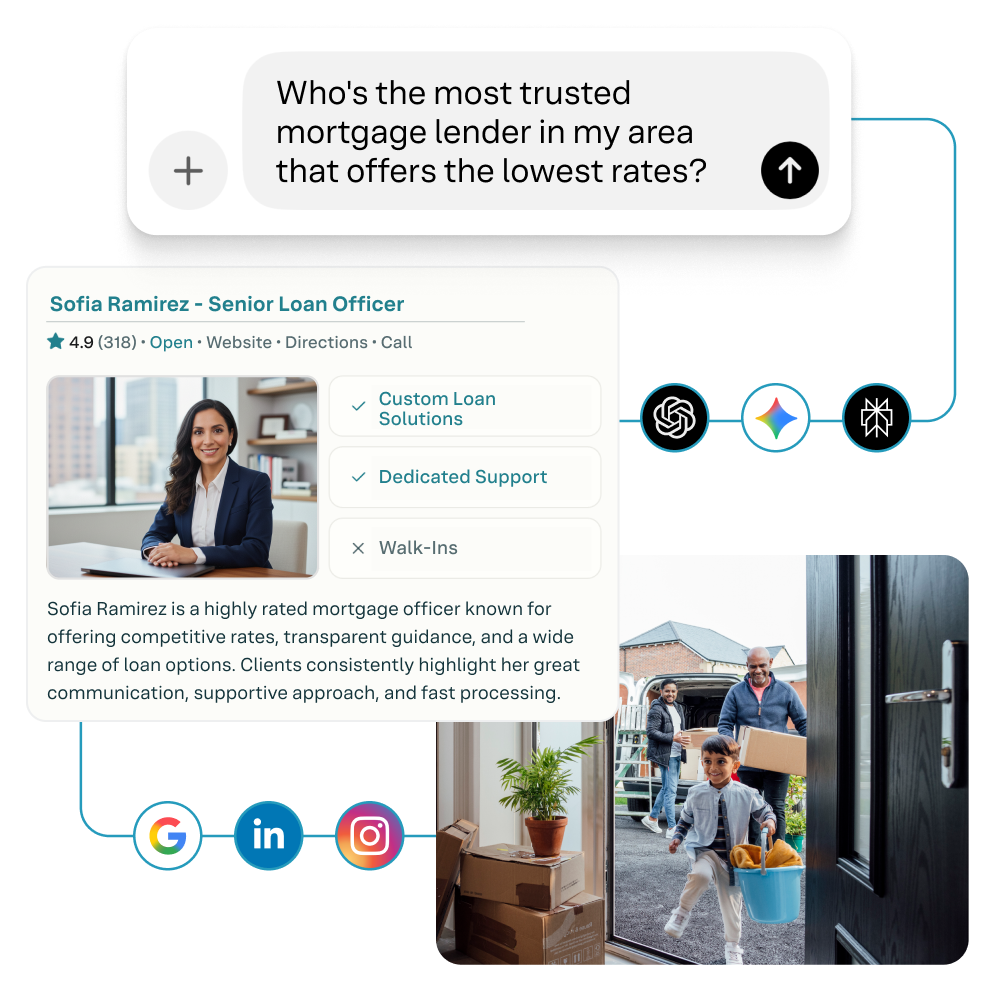

From Google to ChatGPT, Yext ensures your brand shows up first with the right data so borrowers choose you, not the competition.

Capture high-intent borrowers everywhere they search

Borrowers start with Google and AI to compare lenders, officers, and rates. Yext ensures your branches and MLOs show up first with accurate, compliant, AI-ready information so you win visibility at the moment of decision.

Build borrower trust with credibility at scale

Mortgage decisions hinge on credibility. Yext boosts ratings, streamlines review management, and powers compliant local social, helping MLOs showcase expertise, responsiveness, and authenticity at scale so borrowers feel confident choosing you.

Protect compliance while empowering loan officers

In a regulated industry, even one inaccurate profile or off-brand post can erode trust. Yext provides centralized oversight, audit-ready workflows, and brand-approved templates, giving compliance teams confidence while enabling officers to market locally.

See what drives borrower discovery

Replicate real consumer searches across Google and AI engines to measure and understand how your MLOs are being cited, benchmark them against local competitors, and surface the levers that will improve visibility.

Structure data for AI engines

Organize officer, branch, and product details into schema-rich, AI-ready data that fuels accurate, trustworthy results in search and borrower-facing experiences.

Keep branch and officer details accurate everywhere

Listings ensure your locations and professionals stay consistent across 200+ publishers — from Google and Zillow to maps and AI platforms — with direct integrations that update in real time.

Turn reputation into a growth engine

Reviews directly influence borrower choice. Yext automates review generation, centralizes monitoring, and enables fast, compliant responses, boosting ratings and making officers more discoverable at the moment of decision.

Turn search moments into applications

Pages create AI-optimized officer and branch websites with structured data and embedded CTAs like "Apply Now," converting high-intent discovery into leads.

Scale compliant social engagement across every MLO

Empower loan officers to build credibility through professional profiles, personalized publishing, and AI-powered content recommendations, while marketing and compliance teams maintain full control and oversight.

Enhance the borrower experience with 1:1 outreach

Enable MLOs to automate reminders, updates, and follow-ups over text and voice with full compliance guardrails and CRM integrations to keep every interaction secure and productive.

Give borrowers instant answers on your site

Search helps borrowers find rates, loan options, branch hours, and FAQs directly on your website. AI-powered answers reduce drop-off, improve servicing, and move prospects closer to application.

The Mortgage industry loves Yext

The Mortgage industry loves Yext

FAQs

FAQs

Yext makes mortgage lenders and loan officers more visible across Google, Zillow, maps, and AI search platforms. It ensures branch and officer profiles are accurate, compliant, and optimized for discovery. This visibility helps borrowers find you first and drives more applications.

Yext structures your data so it is accurate, consistent, and trusted. AI engines use this information to answer borrower questions, future-proofing your brand as search behaviors evolve and helping ensure your loan officers and branches are surfaced first when borrowers look for a mortgage.

Structured data makes mortgage information machine-readable for Google, ChatGPT, and other AI platforms. Yext organizes MLO, branch, and product data into a single Knowledge Graph that fuels accurate, compliant results. This prevents misinformation and ensures borrowers see the right details first.

Unlike single-purpose tools, Yext combines visibility, reputation, and engagement in one platform. It integrates insights with execution so lenders can act quickly on recommendations. This all-in-one approach reduces complexity and drives measurable results.

Yes, Scout benchmarks MLO and branch visibility against local competitors in both AI and traditional search. It highlights where your officers win and where they fall behind. These insights guide targeted actions to improve performance.

Yext Listings synchronizes officer and branch information across 200+ publishers with direct integrations that update in real time. This eliminates duplicate profiles, incorrect NMLS details, and outdated contact info that hurt borrower trust. By maintaining accuracy everywhere borrowers search, lenders reduce compliance risk and ensure every digital touchpoint drives confidence.

Yes, Yext automates review requests, centralizes monitoring, and streamlines responses to improve ratings. Better reviews increase visibility in search and directly influence borrower choice. Higher ratings translate into more applications and stronger officer reputations.

Yext Pages turn discovery into action with AI-optimized branch and officer profiles that feature clear CTAs like "Apply Now." Pages can be deployed at scale, from dozens to thousands of loan officers or branches, without heavy developer support. This scalability ensures consistent, compliant borrower experiences that convert across every market.

Yes, with Hearsay Social, Yext enables MLOs to share brand-approved, personalized content at scale. Compliance workflows keep everything aligned with regulatory requirements. This builds officer credibility and borrower trust without compliance risk.

Yes, Yext is built so MLOs can manage their brand visibility without technical expertise. Officers get simple, guided tools for updating profiles, requesting reviews, and sharing approved content, all within compliance guardrails. This ease of use drives adoption, reduces errors, and helps every officer build trust with borrowers online.

Yext provides audit-ready workflows, brand-approved templates, and role-based permissions to protect compliance. This ensures MLOs can market effectively while staying within regulatory guardrails. Compliance teams maintain oversight without slowing down local execution.

Lenders using Yext report higher borrower visibility, improved ratings, and faster lead conversion. Accurate data and structured content drive more applications from digital channels. Scout insights and integrated execution turn visibility into real, measurable growth.

Recommended Resources

Recommended Resources