The 88% Advantage for AI in Financial Services

A 2.3M citation analysis reveals how financial brands can take direct control of their AI visibility and how brand websites dominate 47% of all citations

Christian Ward, Adam Abernathy, and Alan Ai, 2025

Oct 29, 2025

Abstract

This research analyzes 2.3 million citations from AI-generated responses to financial services queries across Gemini, OpenAI, and Perplexity. The study introduces a location-level framework that reveals how user geography and context shape citation patterns. Unlike some brand-level analyses that inflate the role of generic sources such as Wikipedia, our location-first approach exposes the dominant AI citation influences for Financial services brands.

We find that 47% of all citations originate from first-party websites, and an additional 41% from listings on third-party directories. The regulated nature of the industry leads AI systems to rely heavily on authoritative, brand-owned information.

The findings suggest that 88% of citations can be directly managed through coordinated oversight of websites and directory listings. These results demonstrate how financial institutions can improve AI visibility by emphasizing accuracy, local presence, and ongoing data control.

Introduction

This research analyzes 2.3 million source citations from AI-generated responses to financial services queries across three major AI models. The analysis establishes location-level and user context as the critical frameworks for financial brands to build a visibility strategy.

Current AI citation research is often based on a brand-level view that overlooks a user's location. This results in misrepresentation of general sources like Wikipedia as top citation sources, which do not reflect realistic citation patterns for consumers seeking financial services. When a consumer's location and context are applied, the citation patterns change dramatically. We dive deep and showcase this phenomenon in AI Citations, User Locations, & Query Context (Ward et al., 2025).

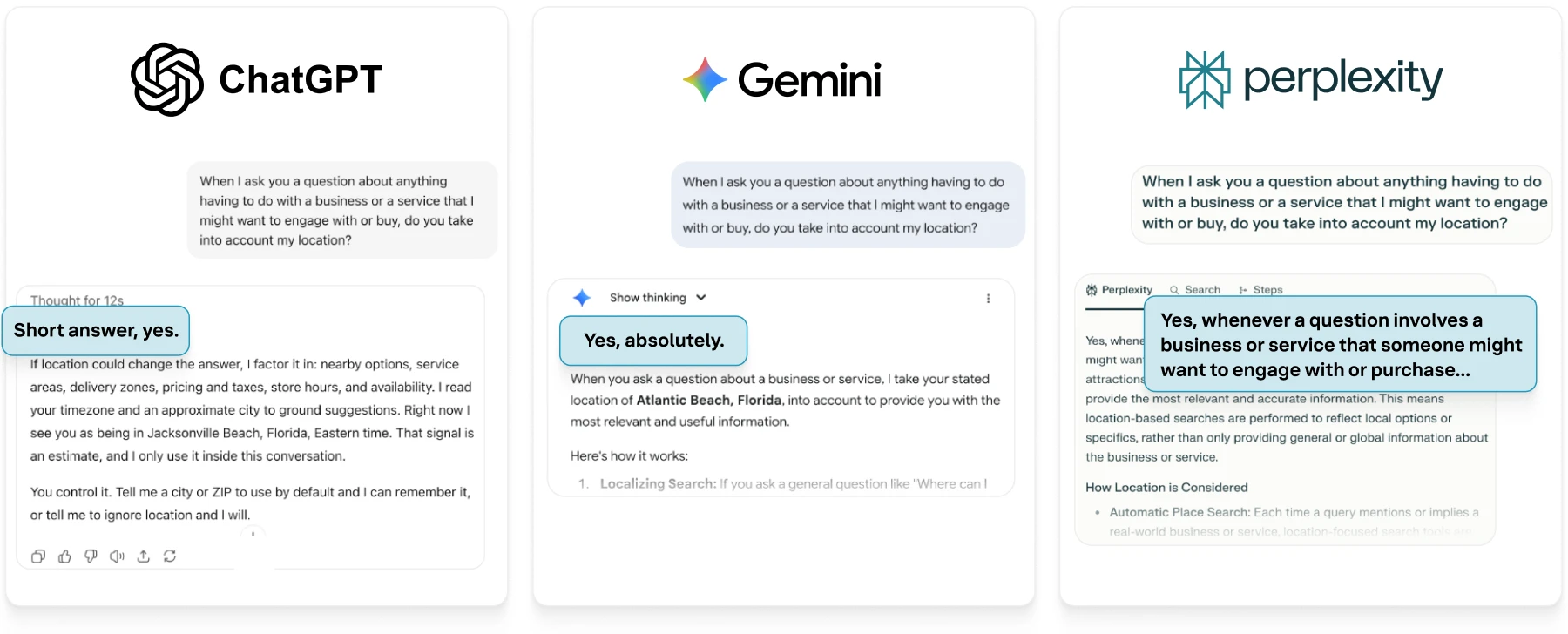

This location-first approach is a stated function of the AI models themselves. When asked directly, models from Google, OpenAI, and Perplexity all confirm the use of the consumer's location when ranking a response involving businesses and services.

Figure 1

Figure 1

In the financial services industry, a location-first view offers a distinct advantage. The data shows that these brands have significant direct control over their AI representation.

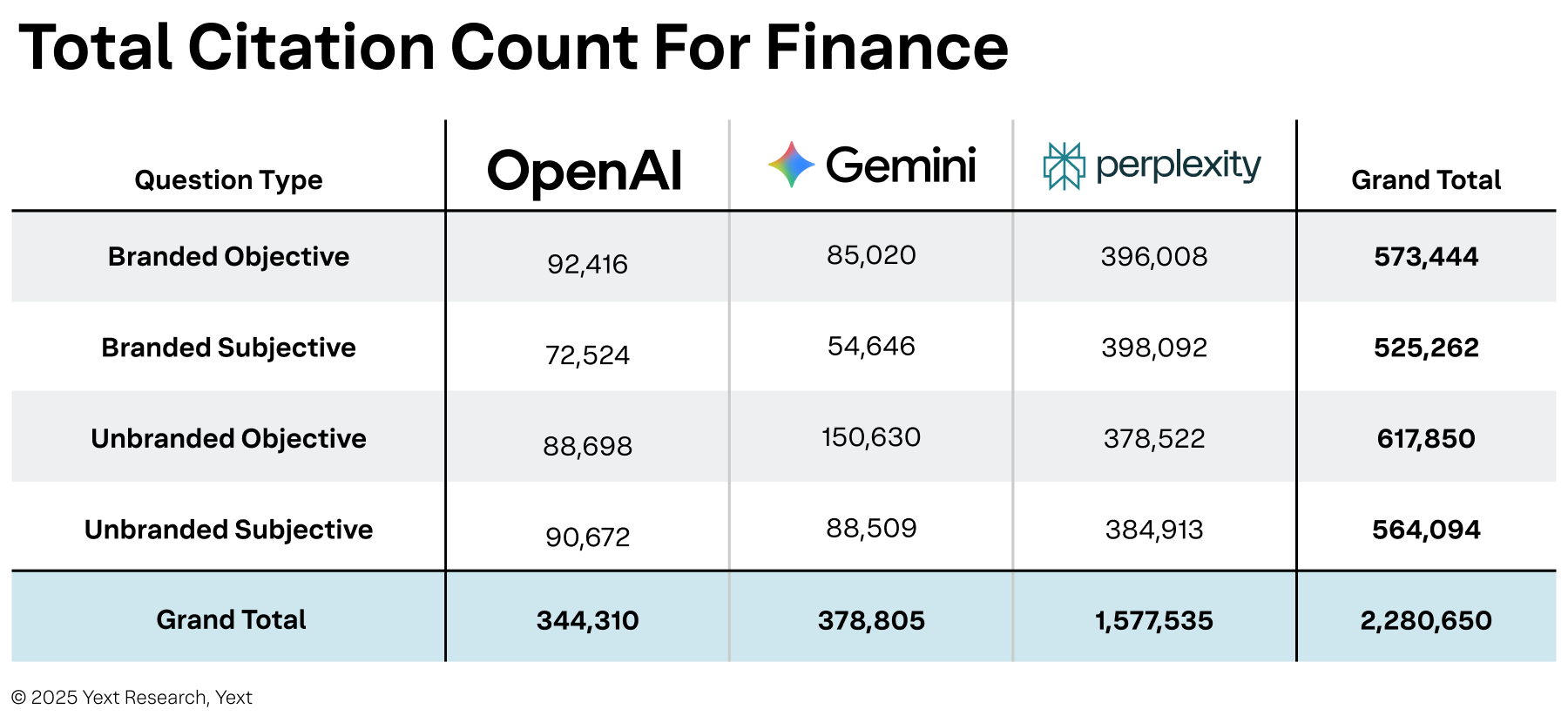

Table 1

Table 1

We find that for financial services websites, and other brand-owned properties account for nearly 48% of all citations. This is likely due to the regulated nature of the industry, which drives AI models to prioritize authoritative, brand-owned sources for information. This research presents a clear and strategic path for financial brands to enhance their visibility in AI.

Key Findings

Location-level analysis reveals citation and source-material patterns that are often undetectable during a brand audit. For example, a retailer’s national report might claim 47% first-party citations, but when viewed from a consumer’s local perspective, the composition of first-party citations might be 70% in rural regions versus 20% in large cities. Location-level analysis restores that detail, turning vague national metrics into actionable insight for local strategy.

-

Location-level analysis is critical: Current AI citation research often overlooks a user's location, leading to general sources like Wikipedia appearing as top citations. However, when a consumer's location and context are taken into account, citation patterns change dramatically, revealing a more realistic view of financial services.

-

Financial brands have high first-party control: Financial services brands have the greatest potential for first-party control over their AI narrative. Brand-owned properties account for nearly 48% of all citations, likely because the industry is highly regulated, prompting AI models to prioritize authoritative, brand-owned sources.

-

A significant portion of citations are manageable: Financial services brands can directly manage the sources that account for approximately 88% of all consumer-facing citations. This includes "Full Control" sources like first-party websites (47% of citations) and "Controllable" listings on third-party directories (41% of citations).

-

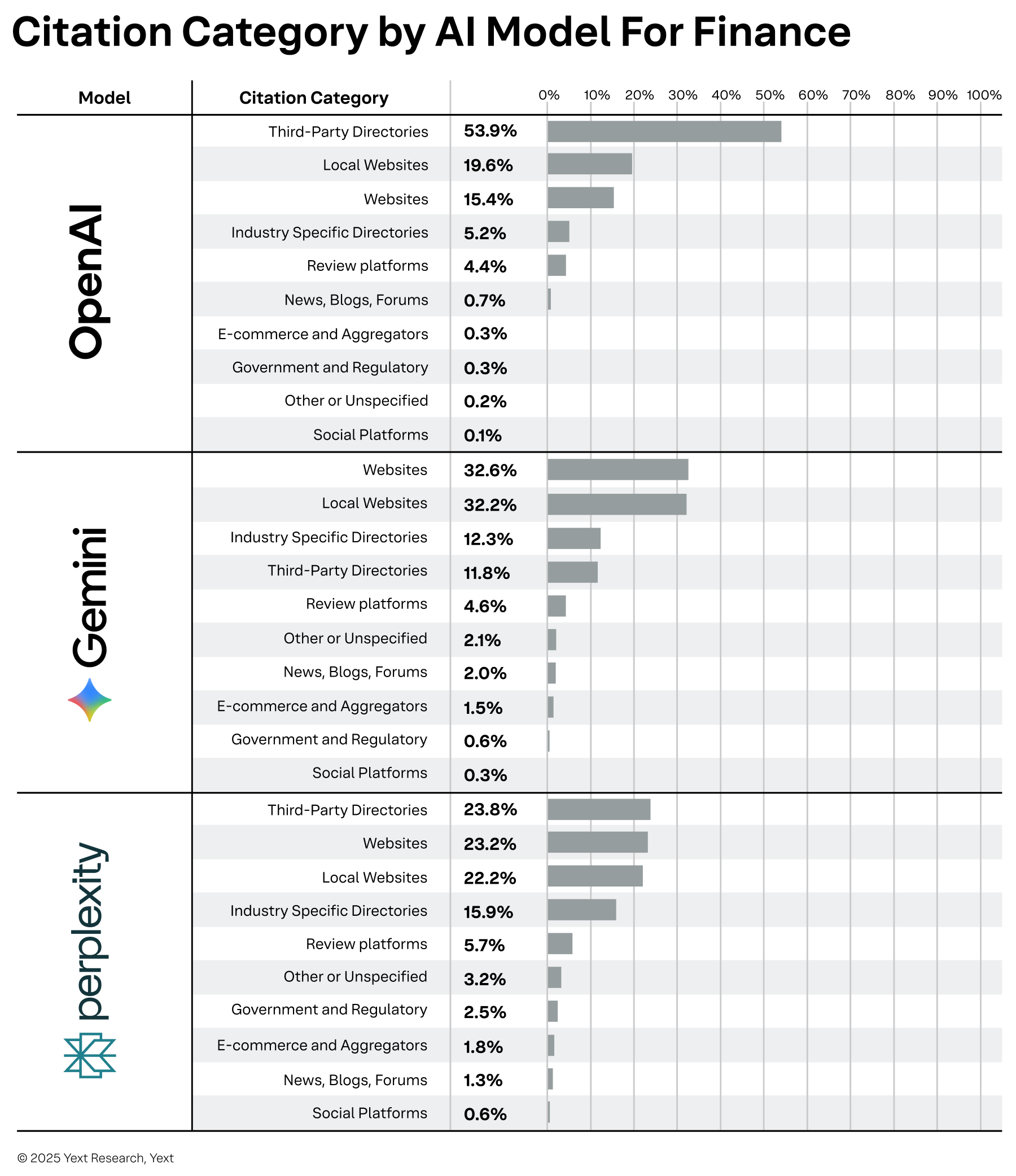

AI model-specific citation behaviors:

- Gemini: Shows a clear preference for first-party content, with corporate and local websites together accounting for nearly 65% of its citations.

- OpenAI: Is highly dependent on third-party directories, which make up 53.93% of its citations for finance-related queries.

- Perplexity: Exhibits the most balanced approach to sourcing, pulling almost equally from third-party directories (23.76%), corporate websites (23.18%), and local websites (22.17%).

-

Local pages create valuable citation surface area. These brand-owned properties, such as branch location pages and advisor profiles, account for a significant portion of citations. This highlights the importance of rich, authoritative content on owned digital properties as AI models prioritize these sources, especially in regulated industries like finance.

The findings suggest a clear pathway for financial services brands to increase their visibility in AI. Brands can find pronounced lift in the low-effort activities of managing both first-party websites and third-party listings. As a brand's control over a source increases, so does its use as a citation.

Methodology

This finance-specific analysis is an extension of the broader research detailed in the Yext Research paper, AI Citations, User Locations, & Query Context. The foundational methodology, including the Location-Context Framework and Control Framework, is fully explained in that original study.

This research is based on an analysis of 2.3 million citations collected from AI-generated responses between July 1, 2025, and August 31, 2025. The data was gathered from a global study of Yext clients and prospects in the financial services industry, utilizing the Yext Scout platform.

Using an automated system, questions were asked for each of the three major AI models: Gemini, OpenAI, and Perplexity, designed to represent four distinct consumer-intent quadrants (Branded Objective, Branded Subjective, Unbranded Objective, and Unbranded Subjective). We tested at every client and prospect location to ground the analysis in a real-world, consumer context.

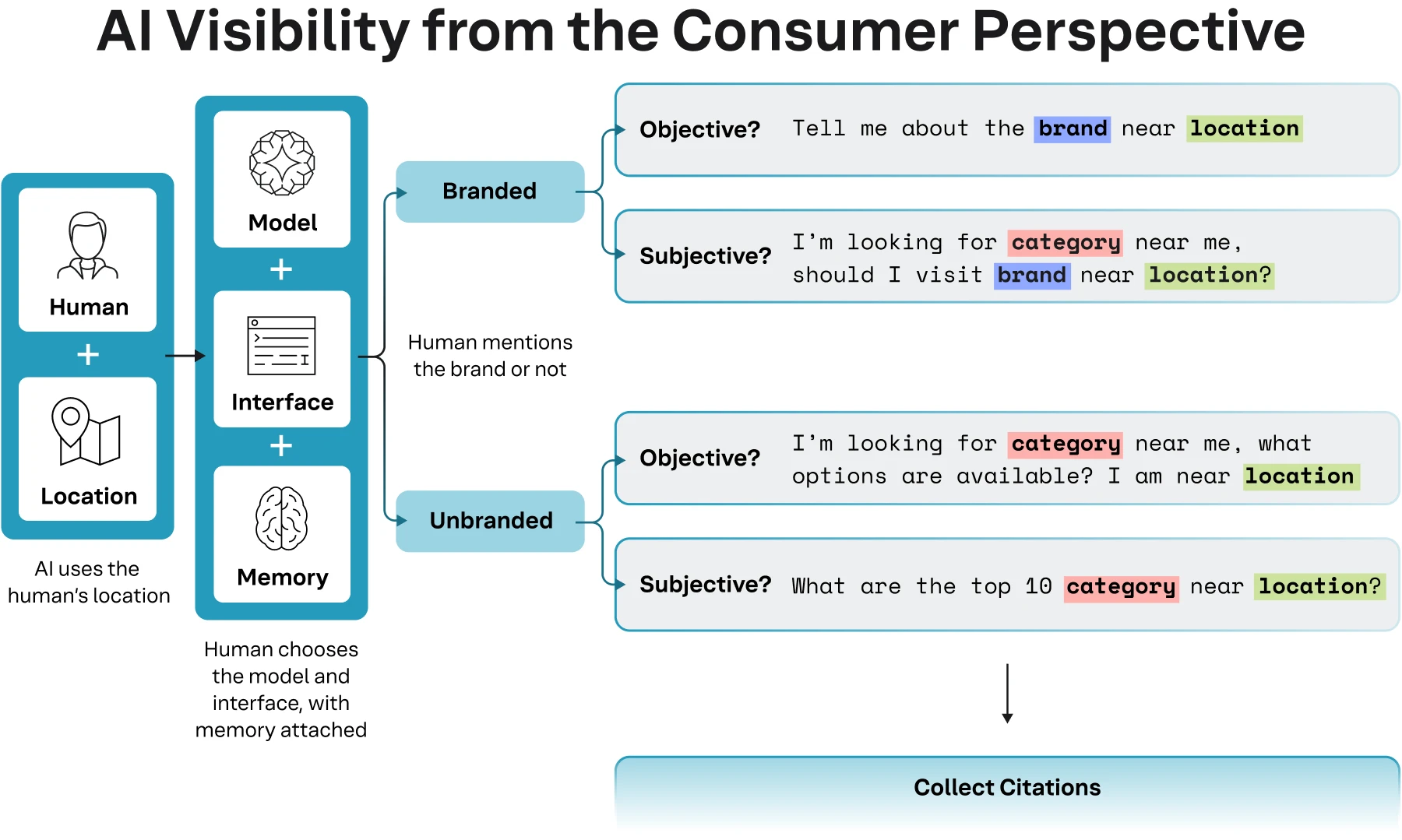

The Location-Context framework

AI visibility needs to be understood through a consumer lens. This research uses the Location-Context Framework, a model that begins with a consumer's location and intent to understand citation patterns. We believe this approach is more accurate and can be rolled up to the brand level.

Based on system prompts released by labs like Anthropic, we have also validated that this methodology closely tracks with how those systems use tools like Web Search and Memory.

Figure 2

Figure 2

When applying geo-location, we find that platforms like Reddit and Wikipedia appear at near-negligible rates. By grounding the analysis in the geographic and contextual reality of a user's query, the resulting citation sources more accurately reflect what a real consumer would see.

Geographic distribution and study scope

The geographic distribution of the business locations in this study reflects the current concentration of clients and prospects in the dataset. This research spans a two-month period; therefore, we expect the citation counts to increase and diversify as more locations and regions are added over time.

Citation counts are noted in each country and region that are returned as responses from AI models with respect to each business or scanned location.

The citation data for this study is generated from where customers and prospects have participated in the Yext Scout platform. The United States currently accounts for the largest collection of citations. Canada (421,248), the UK (125,568), Mexico (29,352), and Australia (23,760) also have a significant representation. Forthcoming research reports will provide additional analysis of citations by industry, geography, and through time.

For now, the key takeaway is that citation patterns are highly dependent on local context, and a brand's visibility strategy must be adapted to the specific digital landscape of each market.

The Control Framework for Financial Services

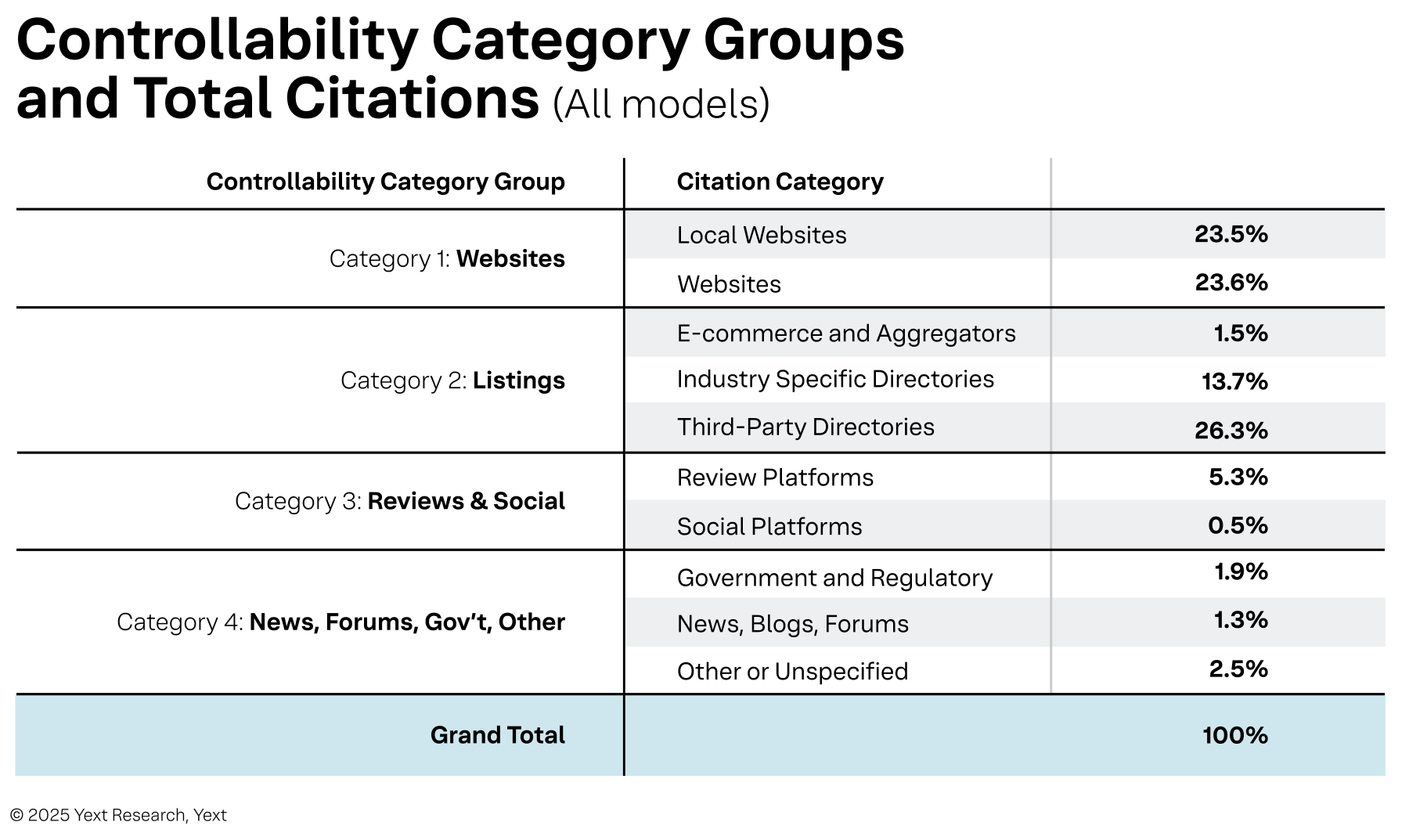

To develop a strategy for AI visibility, it is essential to group citation sources based on a brand's ability to manage the information they contain. The Control Framework organizes citation sources into four distinct categories, moving from sources a brand fully owns to those where it has no direct influence.

Table 2

Table 2

- Category 1: Full Control (Websites) includes a brand's own first-party digital properties. In finance, this accounts for over 1 million citations from corporate domains, local branch pages, and advisor websites.

Note: We define a "local page" as a Category 1 digital property associated with a physical location.

- Category 2: Controllable (Listings) encompasses third-party directories where a brand can manage its profile. This category accounts for over 946,000 citations and includes major platforms like Google and Mapquest, as well as industry-specific directories.

- Category 3: Influenced (Reviews & Social) covers platforms driven by user-generated content where brands can participate. This category accounts for over 132,000 citations from sources such as Google Reviews and other review platforms.

- Category 4: Uncontrolled (News, Forums, Other) includes sources where a brand has no direct control, such as news articles and government regulatory sites. These sources account for just under 130,000 citations.

The most powerful finding is that financial services brands can directly manage the sources that account for approximately 88% of all consumer-facing citations (Categories 1 and 2).

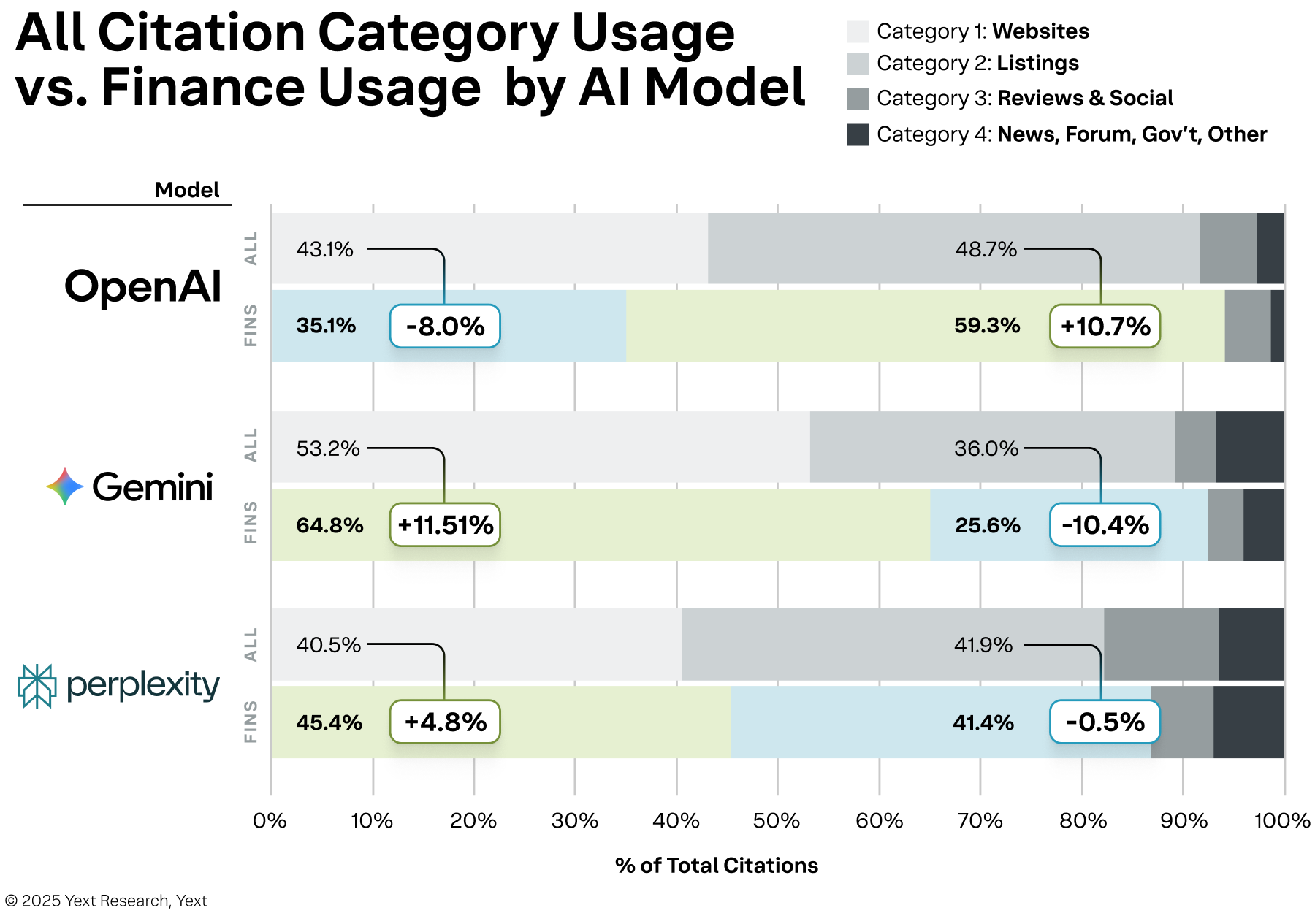

The finance control structure

Financial services demonstrate the greatest potential for first-party control when compared to other industries. With websites (Category 1) accounting for 47% of citations, the regulated nature of the finance industry drives AI models to authoritative, brand-owned sources to answer consumer questions.

Listings (Category 2) are also a critical component, representing over 41% of citations. This shows the importance of maintaining accurate information on both general and industry-specific directories. Reviews and Social (Category 3) and Uncontrolled sources (Category 4) play a smaller but still present role in the citation ecosystem.

Model differences

Detailed Model Citation Behavior in Financial Services

Table 3

Table 3

Citation behavior is not uniform across AI models. A brand's visibility strategy must account for the distinct sourcing preferences of each platform, as their approach to financial queries varies significantly. The specific breakdown of citation sources by percentage reveals clear strategic paths for each model.

- Gemini's first-party focus: Gemini shows a clear preference for first-party content. Corporate websites (32.58%) and local websites (32.18%) together account for nearly 65% of its citations. This highlights the critical importance of rich, authoritative content on owned digital properties for brands wanting to appear in Gemini's results. Its next most-used source is industry-specific directories at a distant 12.32%.

- OpenAI's directory dependence: OpenAI is highly dependent on third-party directories. This single category accounts for 53.93% of its citations for finance-related queries, more than any other model that relies on a single source type. Local websites (19.62%) and corporate websites (15.44%) are secondary sources.

- Perplexity's balanced strategy: Perplexity shows the most balanced approach to sourcing. It pulls almost equally from third-party directories (23.76%), corporate websites (23.18%), and local websites (22.17%). It also has the highest reliance on industry-specific directories (15.88%) of any model. For visibility on Perplexity, a broad and consistent presence across multiple source types is necessary.

Figure 3: The bubbles indicate the change from our previous global AI citation study.

Figure 3: The bubbles indicate the change from our previous global AI citation study.

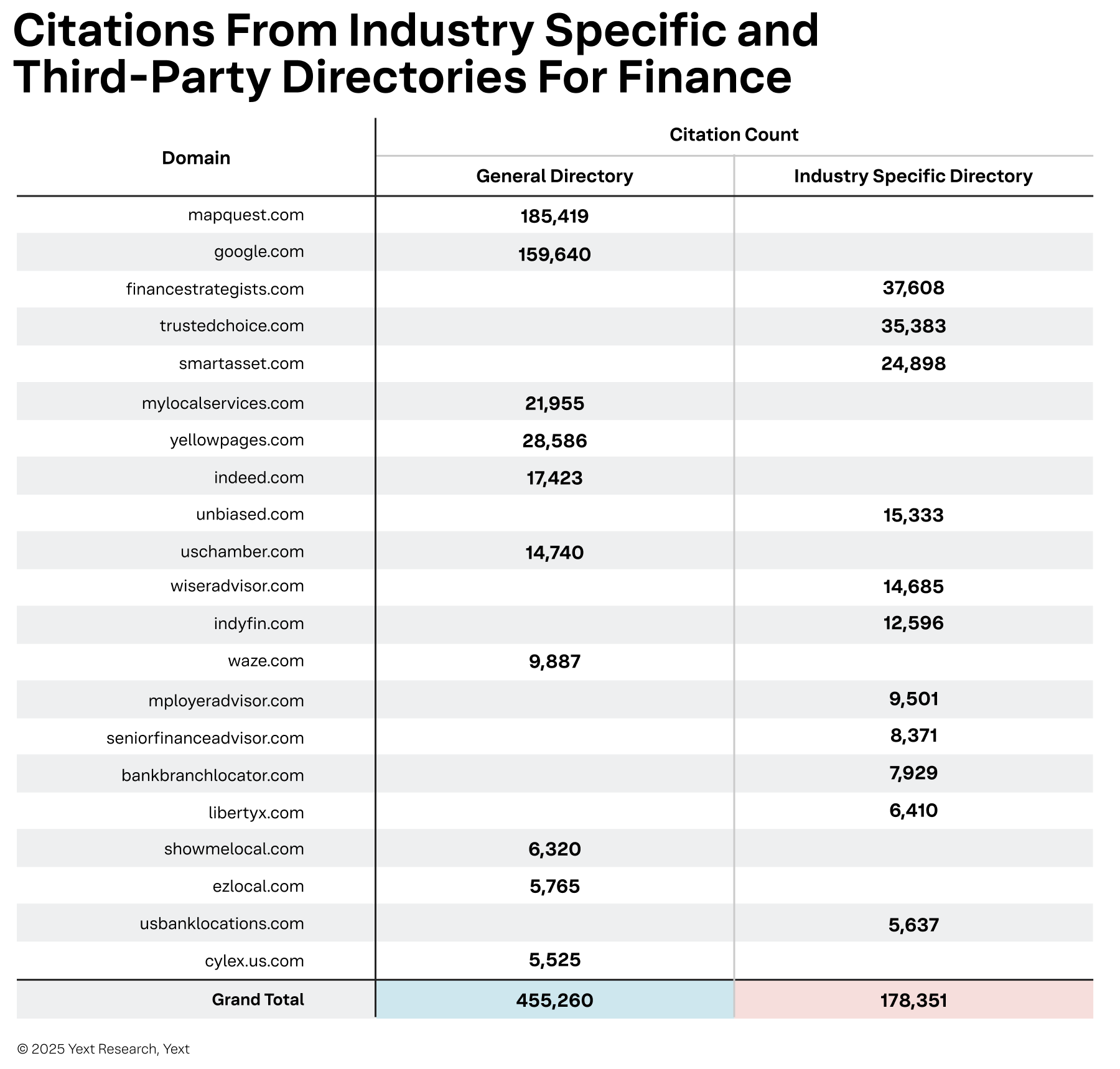

The data distributor landscape and the opportunity for control

The importance of third-party directories when influencing citation potential becomes clear when analyzing specific data distributors. The data reveals a significant opportunity for brands to improve their impact by managing their presence on these platforms.

Table 4

Table 4

Analysis of the leading industry-specific and third-party directories shows that platforms with direct integration, like Mapquest and Google, generated over 425,000 citations. This demonstrates how classic citation management approaches remain highly effective. A brand's own local and corporate websites, combined with its listings on third-party directories, are the places where it can exert the most control. These sources are also the most cited when taking a location-based approach to queries. This is a direct result of moving beyond simple brand-level query fan-outs to a model that reflects true consumer behavior. There is a clear opportunity to work more closely with all third-party platforms to improve a brand’s impact.

The strategic path forward

The findings suggest a clear path for financial services brands to increase their visibility in AI. The relationship between a brand's level of control, the effort required, and the resulting AI citation usage offers a powerful framework for prioritizing actions. As a brand's control over a source increases, so does its use as a citation.

Figure 4

Figure 4

“Full Control” sources, like first-party websites, offer the highest efficacy and represent the largest opportunity in finance (47% of citations). “Controllable” listings on third-party sites are the second most critical area, delivering a high volume of citations (41%) with a moderate level of management effort. This framework allows a brand to proactively focus its resources on the activities that will have the greatest impact on its AI visibility.

Limitations and future research

This analysis has several important limitations. The data is based on scans of Yext clients and prospects over a two-month period. This research also utilizes APIs to gather citation data, and there can be differences between API behavior and the direct consumer experience. Other studies have shown that the consumer experience can be volatile, though the large scope of this analysis helps to mitigate some of that variability.

The AI industry is moving at a rapid pace, with constant model improvements and evolving approaches to citations. This study also does not fully explore the impact of conversational memory, which will have a significant effect on citation patterns in ongoing user sessions. Future time-series analysis will be conducted to track these inconsistencies and changes over time.

Conclusion

A location-based analysis of AI citations quickly provides a clear and actionable strategy for financial services firms. The data shows that financial brands are in a position of strength, as they can directly manage the sources that account for 88% of all citations. This high degree of control is a direct result of AI models prioritizing authoritative sources (potentially due to a regulated industry refinement), with brand-owned websites and local pages alone accounting for 47% of all citations. Based on this and previous research, we expect this trend to continue.

Furthermore, strategies must be tailored to each AI model. A first-party content strategy is critical for Gemini, which draws nearly 65% of its citations from brand websites. In contrast, a listings-first approach is necessary for OpenAI, which relies on third-party directories for over 53% of its citations.

By focusing on the integrated management of first-party websites and third-party listings, financial brands can build a durable, effective visibility strategy that addresses the specific behaviors of each AI model.