Impact of SERP Ranking on Engagement

Investigating CTR performance & Highlights in Unique YMYL Behavior

Arjun Sangwan, Anthony Rinaldi, and Adam Abernathy

Introduction

Not every customer wants the same thing from a search. Understanding these mindsets lets you craft tailored content and data strategies for each type of searcher. This helps brands deliver what each person needs — when and where they want it. Amidst changes in today's search and discovery challenges, brands will continue to seek out and optimize their presence on current and emerging search platforms. When considering traditional local search, we think of the search engine results page (SERP) and what can be done to gain a competitive edge. Yext Scout, our new Brand Visibility Agent, enables in-depth technical and keyword analysis. The main purpose of the solution is to help brands monitor their search ranking performance and gain a comprehensive view of their actual local search competition. We have implemented this solution in two main ways: as both the large-scale search observatory and a location-level scanning tool.

Key findings

- Click-through rate (CTR) isn't always rank-dependent. In high-trust YMYL (Your Money, Your Life) categories like finance and healthcare, clicks don't fall off as sharply with rank as in other industries. People go deeper into the results and still convert, especially when decisions feel personal or costly.

- In healthcare and financial services, users tend to have deliberate intent. Financial services and healthcare providers saw flatter engagement curves, likely because users enter with specific expectations and are willing to dig until they find a match.

- When real money or health is at stake, users act more like researchers than impulse shoppers. Marketers should expect closer scrutiny and optimize their strategies accordingly.

Holistic performance of the Local Pack

Our topic of exploration was to determine the advantages a brand may receive from moving upward on the SERP. By combining Yext Scout data to determine local keyword rankings with Google Business Profile data to assess performance metrics, we evaluated over 51,000 businesses across various industries and sizes. Each Scout scan yielded the first three search results, which we will hereafter be referring to as the "Local Pack", as well as the following 37 ranking spots which fills out a full two pages of local listings results and the Google Business Profile (GBP) data provides us with monthly Impression and click data that we will use to determine customer engagement. To ensure sufficient sample sizes, we grouped the rankings into the Local Pack, ranks 4-10, 11-20, and 21-40, rather than attempting to analyze each of the 40 distinct ranking spots individually. The initial findings were directionally very intuitive; results ranking in the Local Pack receive significantly more views (impressions) than those outside of the Local Pack, and while the pattern continues to hold as you move down the results for each subsequent bucket, the delta begins to shrink. In other words, few people scroll, and even fewer view the second page. While the findings are not entirely surprising, the scale is larger than you may expect, directionally. The median business within the local pack received 2.7 times more impressions than other similar businesses, still ranking on the first page.

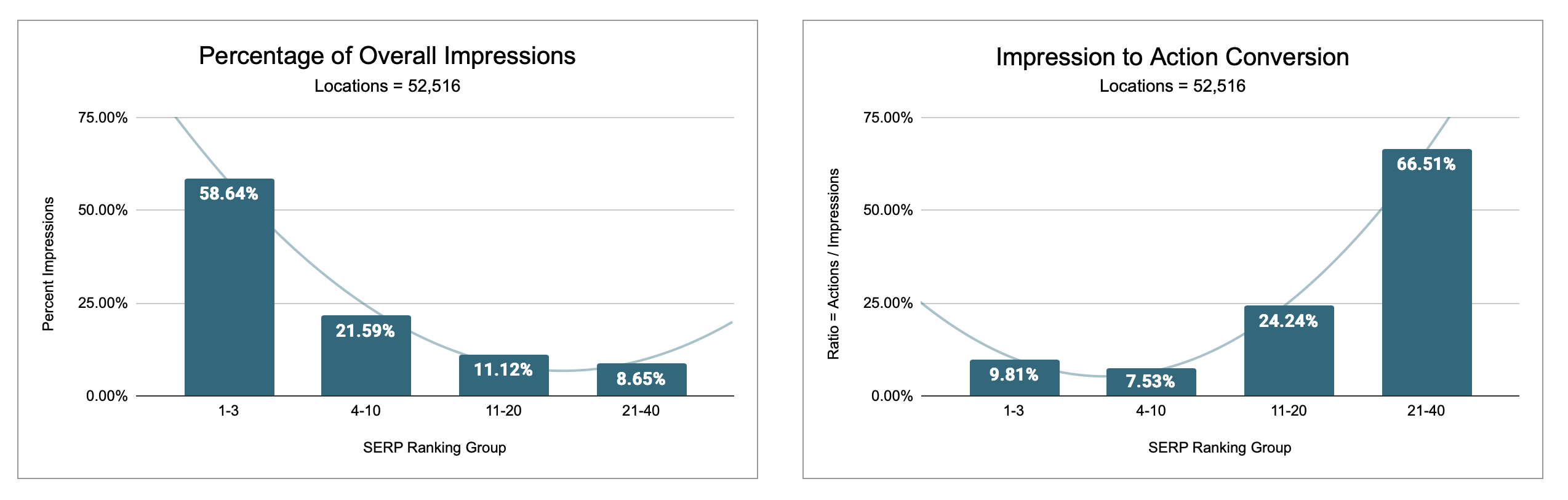

Figure 1A and 1B - Compared to the local pack, organic impressions drop by 52% when ranking 4-10th and >70% when outside the top 10.

Figure 1A and 1B - Compared to the local pack, organic impressions drop by 52% when ranking 4-10th and >70% when outside the top 10.

The findings within engagement (Google Actions such as clicking on a website, tapping to call, or getting directions) was essentially the same directionally, but the drop off from local pack to 4-10 was very slightly less severe, suggesting that people are less likely to scroll but when they do they are almost as likely to engage with the content. A deeper analysis will dive into how these trends may differ by industry and how the relationship between impressions and engagement varies as we move through the rankings.

Unique behaviors for regulated industries

Not every customer wants the same thing from search; therefore, our next line of questioning aimed to identify patterns across different industries. To achieve this, we categorized the data by the terms searched (industries) as well as the results that surfaced (business types). For example, search terms such as "financial advisor", "wealth management", "bank", and "home insurance" would all be filed under "financial services", but within the results, you may get financial professionals such as "advisors" and financial institutions such as "insurance agencies" (Abernathy et al, 2025). Regarding industries, unsurprisingly, the advantage of being in the local pack persists; however, within retail and occasionally hospitality, once users reach the first page, they become more likely to engage with content, not less.

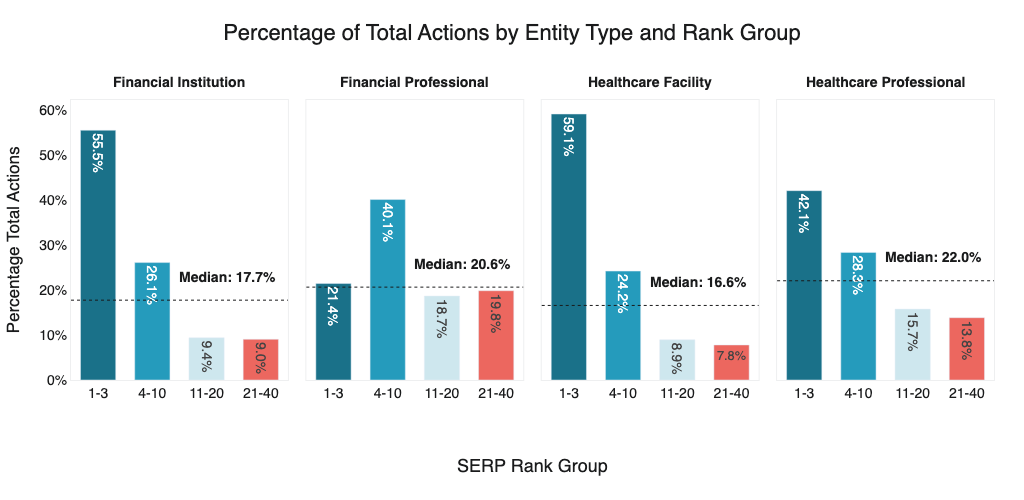

Where things get interesting are within the business types in these regulated industries. When we drill down into the types of segments, such as healthcare professionals, we see the smallest drop from local pack to 4-10. Within financial professionals, we actually see that results in the 4-10 range get more engagement than those in the local pack. Why might this be? Our hypothesis is that when it comes to picking a person (professional), the behavior is different from picking a business.

Picking a person to work with in financial services or healthcare is a more intimate selection where people may want to do more due diligence, that is to say people are less likely to blindly select a result served up to them at the top of the page and more likely to take more time with their selection when making bigger life choices.

Figure 2 - Financial Professionals ranking 4th-10th outperformed the local pack significantly, accounting for more than double the total share of actions.

Figure 2 - Financial Professionals ranking 4th-10th outperformed the local pack significantly, accounting for more than double the total share of actions.

Counter-intuitive CTR?

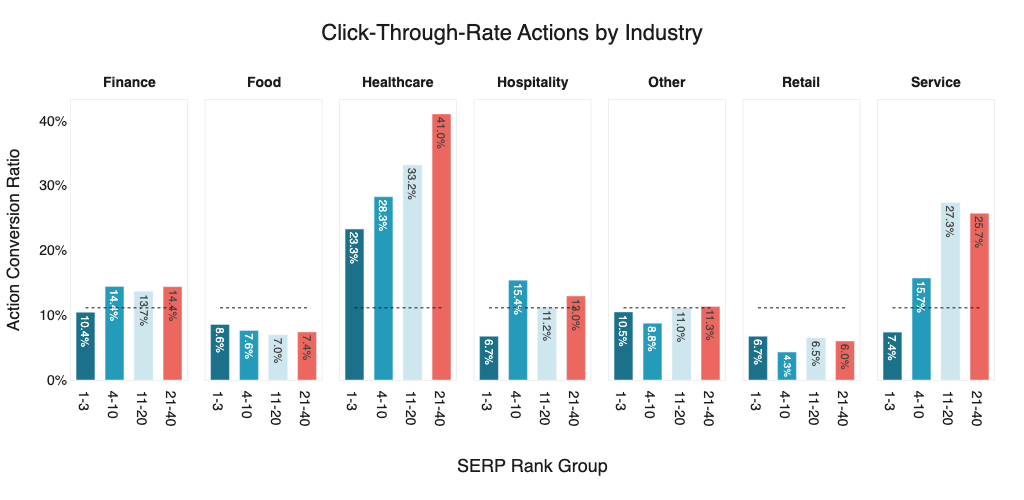

Up until now, everything we have found in the data has been fairly intuitive. It's natural to believe that when considering organic search rankings, not only are you more likely to get more views, but also more action events, the closer you are to the top of the results stack. However, for YMYL (Your Money, Your Life) industries, our findings show a steeper roll-off in impressions - an unexpected result and a contradiction to intuition. For healthcare and financial services, results further down in the results had a higher CTR ratio. These results do not yield overall higher volumes of engagement, but when people scrolled to the bottom of the second page, they were more likely to settle on a result and take action.

Figure 3 - CTR vs Rank by Industry

Figure 3 - CTR vs Rank by Industry

Methodology

This research focuses on understanding the intricate relationship between a SERP ranking and key engagement metrics. Specifically, the correlation between a given SERP rank and three key performance indicators: the total number of impressions, the volume of clicks, and the resulting CTR. Impressions are counted towards a listing whenever it appears on a map or search result. From a metric standpoint, it is the highest level of visibility that businesses can track for their brand on traditional search engines. To provide a comprehensive view of "clicks," we broadened our definition to include not only traditional website clicks but also other direct actions taken by users, such as "taps to call" and "get directions", all of which represent a direct intent to interact with the listed entity. The CTR was calculated as a ratio, where the total number of user actions (inclusive of website clicks, taps to call, and directions) was divided by the total number of impressions received by the SERP listing. This metric provides valuable insight into the effectiveness of a listing in prompting user engagement relative to its visibility.

(Actions / Impressions) * 100

For the purpose of identifying potential trends, we systematically grouped the observed SERP ranks into distinct categories. This categorization allowed us to examine how different tiers of ranking performance impact the aforementioned engagement metrics, providing a more granular understanding of the data than a simple linear correlation. We also used median rather than total values to account for outliers and to normalise the data across industries.

Table 1: SERP Location and Definition

| SERP Location | What it Means |

|---|---|

| Top 3 | This represents the businesses showing up in the Local Pack on the first page |

| 4-10 | This represents the businesses showing up in the top 10 on the first page, but not the Local Pack |

| 11-20 | This represents the businesses showing up on the bottom half of the first page |

| 21-40 | This represents the businesses showing up on the second page of the map pack |

Table 1 - SERP Location Definitions

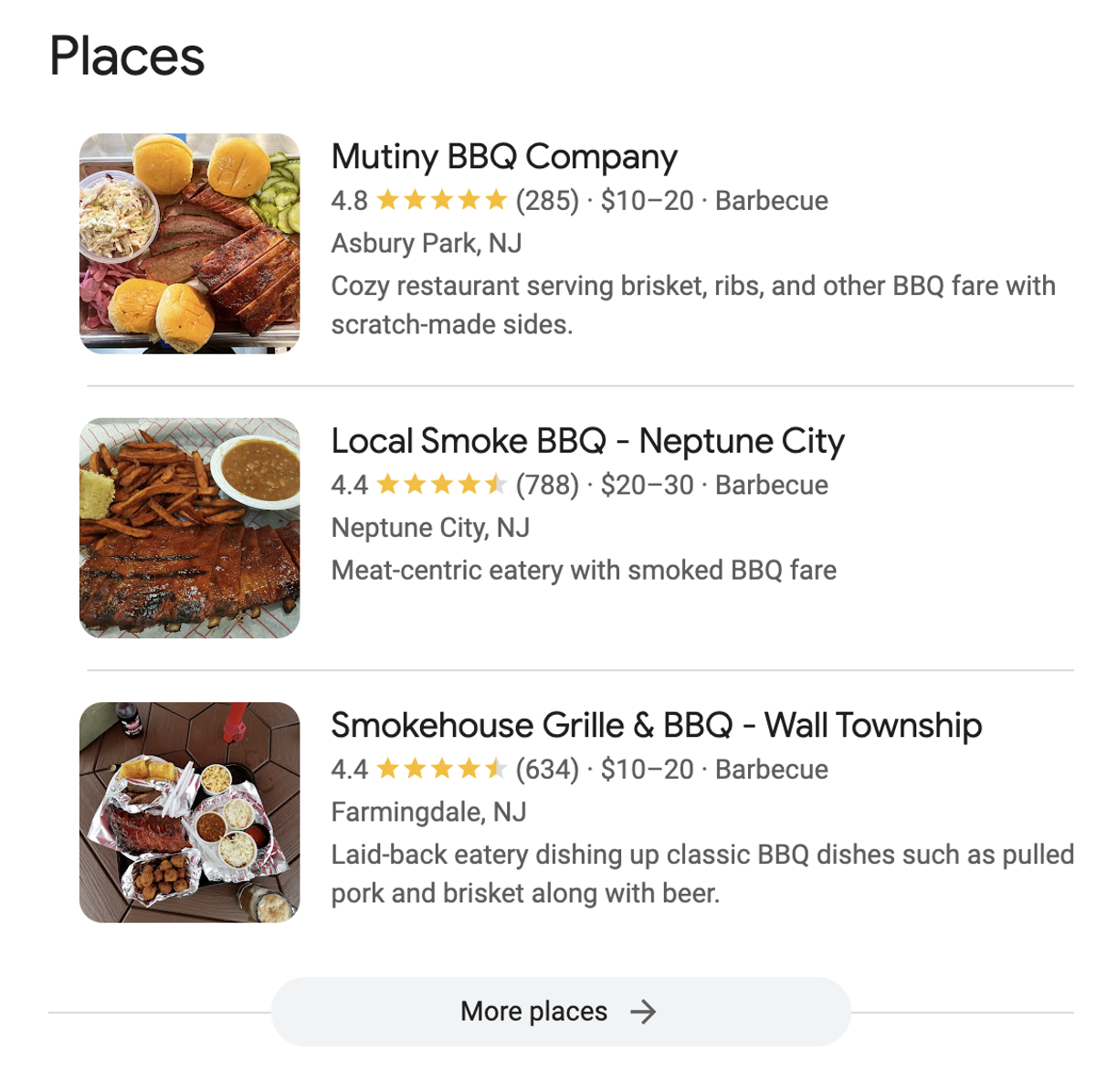

Figure 4 - An Example of the Google’s Top 3 (Local Pack)

Figure 4 - An Example of the Google’s Top 3 (Local Pack)

For locations that appear in multiple searches, we selected the one with the highest ranking. For example, a location in ZIP code A could appear in a search in neighboring ZIP code B as well. In that case, we would select the location with the higher rank, which was more likely to be the search run within its own zip code.

Takeaways

Financial and healthcare providers trace a flatter curve

Google's YMYL classification holds Financial Services and Healthcare to a higher standard of accuracy and trust. But how users behave while searching within each category reveals something interesting. People appear far more willing to spend time evaluating individual financial and healthcare providers compared to actual facilities or institutions, even though both involve high-stakes decisions. What this means for marketers is that users appear willing to sift through more results when money is at stake. We suspect they enter the query with firmer expectations and are focused on fee structures, product mix, reputation, and will browse widely until they find a firm that meets those criteria. This behavior suggests a difference in perceived decision-making power. When it comes to money, users often bring more defined preferences, and they're willing to invest time verifying that those preferences are met. Future research could focus on how trust, prior knowledge, and risk perception shape engagement patterns in other YMYL subcategories. It also raises questions about how marketing strategies might adapt to the reality that not all high-trust categories behave the same way once users begin to search.

In Summary

This study reinforces a core truth about search behavior: rank still matters — but how much, and why, depends heavily on context. Engagement is not a flat metric; it's shaped by urgency, perceived expertise, and the degree of user confidence in their own ability to judge. For brands in healthcare and finance, the stakes are high, but the strategies must differ. Where some industries rely on visibility and immediate trust cues, financial and healthcare services rely on patient, comparison-driven browsing. A one-size-fits-all approach to local SEO overlooks the subtle yet meaningful distinctions in how users interact with each industry. Listings in lower ranks, though viewed less often, tend to attract more decisive clicks. These users are clearly motivated and willing to explore past the top results, especially when the stakes involve financial decisions. Rather than fixating on raw visibility, marketers should be asking who is seeing their listings and what those users are prepared to do. A listing that attracts 100 glances but no action is less valuable than one that turns 10 views into 5 clicks. The often ignored long tail may harbor hidden intent worth tapping into with smarter content and positioning. SEO has never been static, and as industries grow more competitive, simplistic rank tracking is giving way to measuring actionable insights that reflect real-world behavior. The value of a high SERP position is not universal; it is mediated by the vertical, the type of business, and what users are looking for. Success in local search increasingly depends on how well a business aligns its presence with the way people actually make decisions. Visibility may open the door, but trust and relevance get people through it.