Optimizing Keyword Selection for Local SEO

The local competition advantage: select optimal keywords based on local competitors.

Ariana Martino and Adam Abernathy

Aug 4, 2025

Abstract

Keyword selection remains one of the most challenging aspects of local SEO, especially for multi-location brands where costs and logistics scale rapidly. This paper presents a data-driven methodology for identifying and evaluating keywords that accurately capture local search intent while minimizing redundancy. Beginning with primary and secondary Google Business Profile categories, the approach maps related keywords to distinct search topics based on behavioral relevance and market indicators, including search volume and cost-per-click. A key innovation lies in expanding competitive analysis beyond Google's first page of results, scanning deeper into search engine rankings to identify hidden competitors and unexpected category overlaps. This broader view often uncovers insights into user intent and market dynamics that are invisible at the surface level. By visualizing keyword relationships, brands can strategically select three to seven high-value terms per location, rather than bloated synonym sets.

Introduction

For any local SEO strategy, selecting the right keywords often feels like a shot in the dark. Marketers, even seasoned ones, can easily default to an overly simplistic or bloated keyword set due to the sheer volume of possible queries, diverse business offerings, and regional variations in search behavior.

Key questions that often arise:

- Should every location track its primary category?

- Do you incorporate product and service keywords?

- What about geo-modifiers like "near me" or city-specific terms?

- How many synonyms are enough to understand a search topic?

These questions are particularly crucial for multi-location operators. For brands with hundreds or thousands of locations, keyword tracking can become prohibitively expensive and logistically challenging. This is why a clear, data-informed methodology is needed to pinpoint optimal keyword sets that maximize search discoverability while minimizing costs. This paper presents a straightforward and data-backed strategy for identifying the optimal set of keywords. This strategy helps to strike a balance between the value of the information returned and the cost of monitoring more Search Engine Results Pages (SERPs). The methodology presented here builds upon and extends work performed for keyword selection used in the Scout Index (Abernathy et al., 2025).

From categories to search topics

We started with a simple principle: your business category should guide your keyword selection. The primary category from your Google Business Profile acts as the initial seed for exploring relevant search topics. Secondary categories then provide additional seed points, covering other lines of business or service offerings. For example, a "massage spa" might also list "facial spa" or "day spa" as secondary categories. These categories form our first conceptual groupings of related keywords, capturing various user intents. Once we've identified initial search topics that reflect user intent and align with your brand, we broaden our scope to include related keywords that further enhance relevance. These are keywords that show high thematic similarity and behavioral overlap. Our analysis of keywords uses two key metrics:

- Related relevance: This score of similarity between a pair of keywords is derived from search engine behavior, user activity, and overlapping SERP results.

- Search volume and Cost-per-Click (CPC): These metrics serve as good indicators of popular user searches and advertiser willingness to pay. They provide valuable insight into market demand and keyword value.

Go beyond page one

Where our approach becomes novel is the expansion of what constitutes competition. We felt it necessary to expand this definition, as historically, most analyses have only relied on Google's first page results. As a result of our other research efforts, we have noticed that there are often worthwhile lessons to be resting in the longer tail of search results. This is where surface-level analysis can fall short. When you look at the longer tail, the wider lens often reveals unexpected dynamics. For example, when evaluating the performance of a global burger chain, we observed that fast-casual chicken and Asian cuisine brands were outranking them. We suspect it's because Google interpreted the user's query intent ("I'm hungry, where should I eat?") rather than the assumed product-specific category ("burgers"). These insights would be invisible if our analysis stopped at the first 10 results. Knowing there's value in the long-tail, we leveraged Scout and the Scout Index (Abernathy et al., 2025) to provide us a wide-angle view of local competition. Scout returns the top 40 local competitors. In most cases, the distinguishing factors between the top 10 results are minimal, but there is a reason they are the top.

Identification methodology for optimal keyword sets

For our experiment, we utilized a dataset of approximately 4.5MM unique keywords and their respective engagement. To test the methodology, the data was used to identify optimal keywords for locations in four industries: Massage Spa, Fast Food Restaurant, Resort Hotel, and Insurance Agency. Primary Category of location serves as a ‘seed’ keyword to begin our search, confirming what general area of business the location operates in.

Businesses can also have Secondary Categories highlighting additional areas of business, products, or services the location provides. These can serve as a ‘seed’ for additional Search Topics that you may also want to keep track of.

Thus, the experimental strategy for finding the optimal keywords set for a location was:

- Start with Primary Category as a way to seed the first Search Topic

- Use data about related keywords (keywords with similar traffic patterns and results) to find other ways this Search Topic can be phrased

- Find the most highly searched candidate keywords that represents the Search Topic

- Repeat the process for any Secondary Categories that represent additional Search Topics

- Run test local searches for each candidate keyword at the business’ location with Scout

- Measure the incremental information provided by each additional keyword search (e.g., the number of net-new competitors identified in the search results)

- Compute the subset of keyword candidates that optimizes for maximal net-new information with the fewest searches required

This experimental approach allowed us to analyze trends in optimal keyword sets, such as typical size and semantic diversity of the keywords.

Visualizing keyword relationships

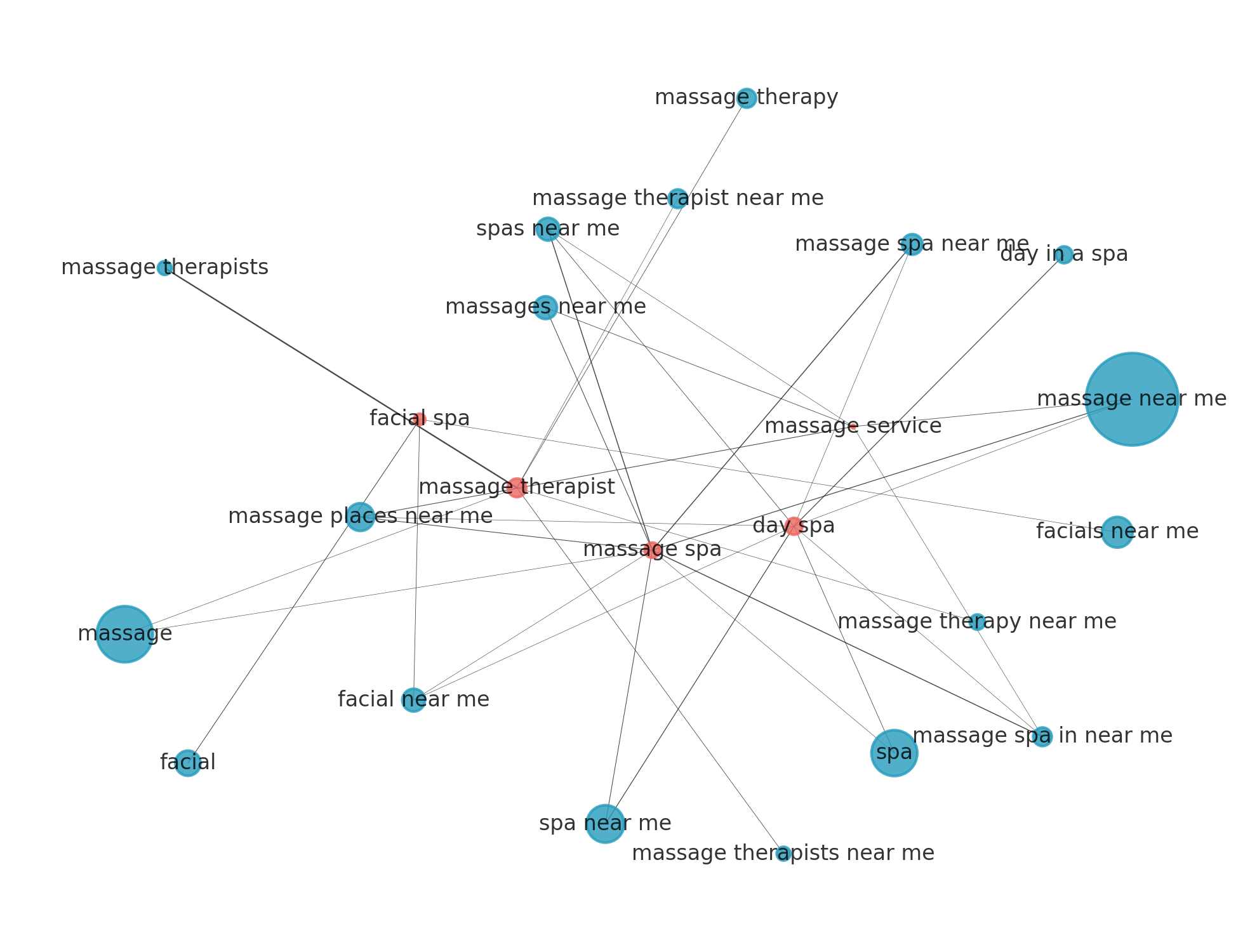

Visualizing keyword relationships makes it clear: not all related terms are equally valuable. This can be seen in Figure 1, where we are looking for keywords for a business with the (Google Business) Primary Category "Massage Spa." Some keywords, like "massage near me" dominate in volume. Others, like "facial services" represent entirely different Search Topics with distinct user intent. Businesses that offer multiple services can and should track distinct keywords to evaluate performance across these different consumer journeys.

Figure 1 — Related keyword nodes for the "Massage Spa" category. Red nodes represent seed categories; blue nodes represent related keywords. Node size indicates search volume; edge strength reflects related relevance.

Figure 1 — Related keyword nodes for the "Massage Spa" category. Red nodes represent seed categories; blue nodes represent related keywords. Node size indicates search volume; edge strength reflects related relevance.

One surprise from our findings was the relative underperformance of city-specific or ZIP code geomodifiers. While "near me" variations consistently rank as high-volume keywords, queries like "massage spa in 10011" are far less common.

Optimizing the keyword set

We compared the SERPs of multiple candidate keywords (like those in Figure 1) to identify the set that produced the most new information with the fewest keywords. Expanding your keyword set comes with a computational and financial cost. More keywords require more SERP scans, and when spending on CPC at scale, that adds up quickly. Our solution? Apply an optimization routine to select a minimal set of diverse, high-value keywords that maximizes information gain. Our findings suggest that 3 to 7 keywords per location strike the right balance. These keywords should cover distinct Search Topics, not merely synonyms of a single idea. For example:

- Good: "massage near me," "facial", and "day spa"

- Redundant: "massage spa", "massage services", and "massage near me"

This diversity ensures broader insight with fewer queries.

Limitations & future work

- Temporal drift: Logically, there is inherent seasonal fluidity of user search behavior, where the relevance and meaning of queries can drift over time due to seasonal changes, current events, evolving trends, or even subtle changes in societal lexicon. Therefore, we are continuing to gather data on user search behavior, keyword performance, and SERP ranks to monitor trends over time.

- Cross-channel signals: Cross-channel signals are a potential area for future development. Currently, our analysis primarily focuses on organic search performance. However, to achieve a more holistic and accurate understanding of a keyword's true value, looking at cross-channel activity could shed additional light.

Conclusion

Optimizing keyword selection for local SEO requires a strategic approach that prioritizes product representation, keyword diversity, and localized performance tracking. Businesses should identify a focused set of keywords aligned with their top products, starting with their primary and secondary Google Business Profile categories. It's important to emphasize diverse keywords over mere synonyms to gain a more comprehensive understanding of performance. For many businesses, 3-7 distinct keywords per location can strike the right balance, maximizing information gain while minimizing cost. Finally, continuous tracking of these keywords at the location level is essential to pinpoint geographic weak spots and drive improvements in search discoverability.