AI Relies on Brand-Managed Sources for 88% of Financial Services Citations

Search has fragmented — but for financial services organizations, influence is still in your hands.

Algorithms decide what your customers see now that AI has collapsed the “optionality” of search into a personalized conversation. Ten blue links have been replaced with tailored AI-generated answers, compiled based on your inferred intent, preferences, and context from past conversations.

The big question is, how do we, as marketers, respond to this change and make sure our brand, agents, and advisors show up on popular AI platforms?

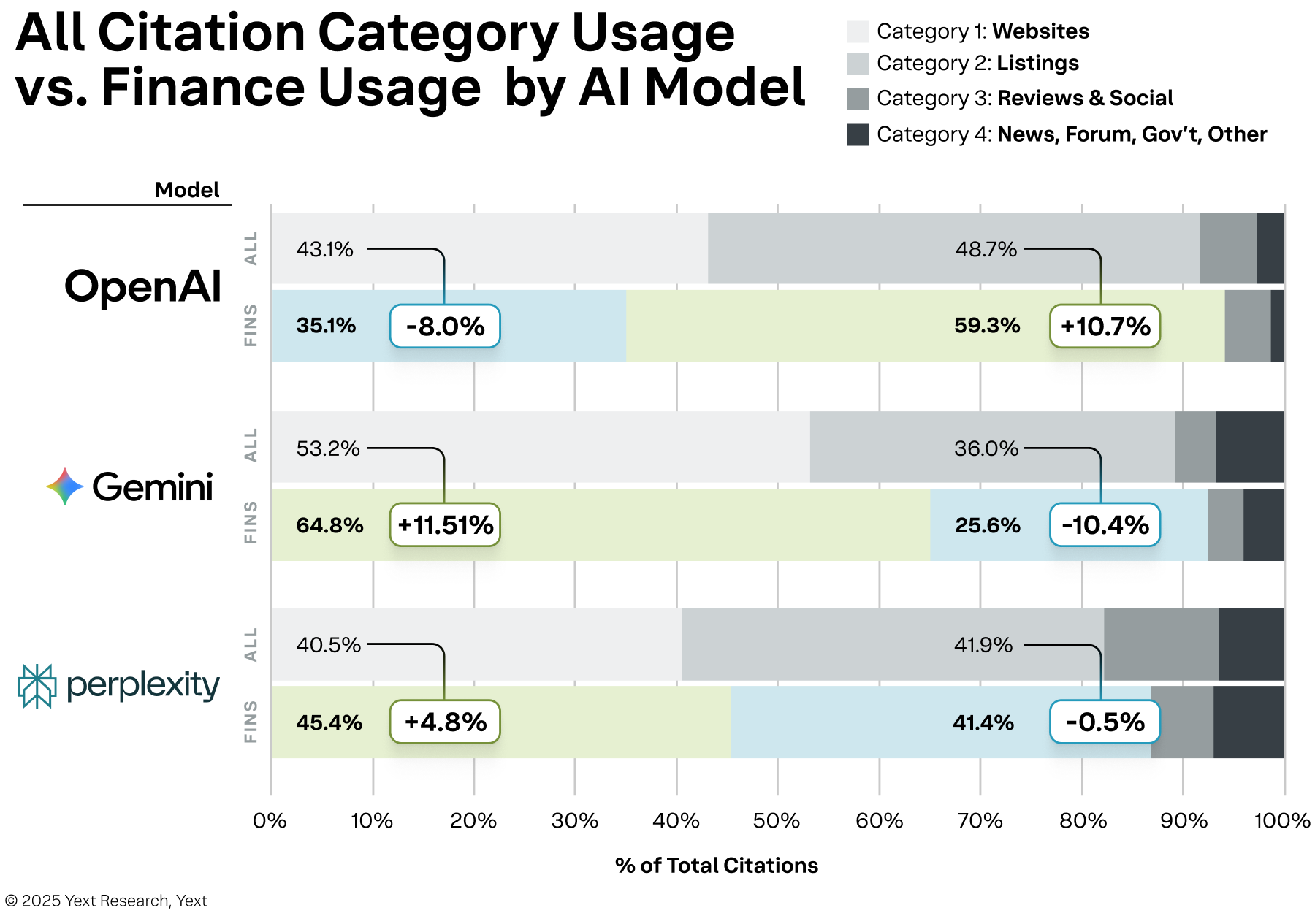

Yext Research analyzed 2.3 million AI-generated citations in finance-related queries across Gemini, OpenAI, and Perplexity, and our findings upend conventional assumptions about visibility.

When we asked financial services questions, nearly half of all citations (47%) came from brand-owned websites, and another 41% came from third-party listings that brands directly manage. This means financial firms can influence almost 88% of the sources AI relies on.

In traditional search, that kind of control would be impossible. In AI search, it represents an incredible opportunity.

AI visibility formula: Financial services edition

Past research has shown that first-party and third-party directories do much of the heavy lifting. However, the “recipe” in financial services is a little different, likely due to industry regulation, and finance is a your money, your life (YMYL) topic. In case you’re unfamiliar, YMYL is a Google-coined term used to describe content that can impact a person’s finances, health, safety, or well-being. Given the high stakes involved, AI models are prioritizing authoritative sources over third-party commentary.

Because AI vets and prioritizes information on your clients’ behalf, AI search has changed the rules of optimization – and financial service brands need to adapt or they’ll disappear. This shift should concern all marketers, but our new research should serve as a motivator. For the first time, data shows that financial service brands have a significant influence on their ability to appear in AI search.

Here's what our research uncovered about where AI models are sourcing information for financial services queries:

AI rewards authoritative, structured, verifiable information – but the way different models prioritize data is not one-size-fits-all.

Our study shows distinct sourcing patterns across the leading engines:

- Gemini strongly favors first-party authority:** nearly two-thirds of its citations come directly from corporate and branch-level websites. If your owned content doesn’t answer real financial questions in real detail? Gemini will move on.

- OpenAI, on the other hand, leans heavily on third-party directories. More than half of its citations come from listings. If your profiles are outdated, incomplete, or inconsistent, you are leaving customers — and revenue — on the table.

- Perplexity takes a balanced view. It pulls almost equally from listings, corporate sites, and local pages. Consistency is the cost of admission. Nothing can be neglected.

Understanding how models prioritize data is only half the story. The other half is how real people are changing the way they ask questions — and what they expect in return.

The human side of AI search

More than half of U.S. adults already use AI search, and six in ten Google queries now terminate in an AI-generated answer.

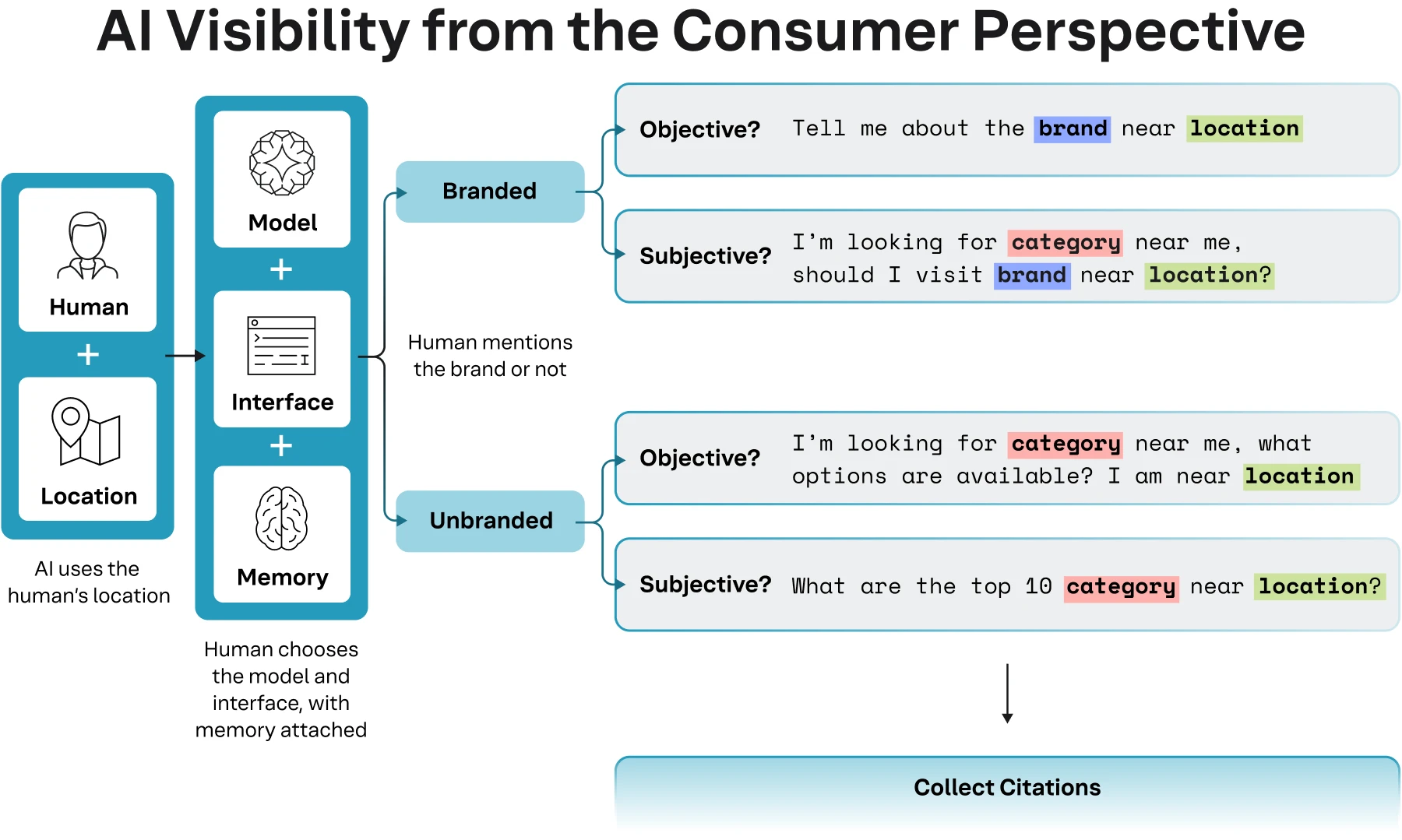

Queries have shifted from simple questions to complex interrogations. People are asking things like: “Which credit union offers the best CD rate without an early withdrawal penalty?” They ask with context, emotion, and urgency, and they expect a complete answer.

To capture that reality, we developed the location-context framework, which classifies AI queries into branded or unbranded and subjective or objective.

Most real-world financial questions combine all four dimensions because finance is personal and local. Answers must be, too.

The new rules of brand visibility

It’s clear that optimizing for AI search requires a strategy shift, and we know that visibility comes from accuracy and proximity to consumer intent. So how do you win?

- Priority #1: Own your narrative by strengthening owned content so AI has credible information to cite. Start by making sure your naming conventions are consistent, using short, clear paragraphs free of jargon, citing data linked to authoritative experts, and incorporating easily verifiable facts and quotes that can be taken out of context.

- Priority #2: Optimize every location page. Make sure that all your listing profiles are complete and verify that your hours, services, pricing, accessibility information, and so on are accurate everywhere they’re published online, because detail is what allows models to match clients to the right branch or advisor. Treat listings as infrastructure, not an afterthought, because 40% of citations on average come from these profiles.

- Priority #3: Differentiate your strategy by model because Gemini, OpenAI, and Perplexity reward different behaviors. Don’t get overwhelmed by the nuance, but make sure you understand key differences so you know what to do if you’re showing up well on ChatGPT but aren’t as visible on Gemini.

The new visibility formula isn’t complicated, but it is different

AI hasn’t killed search; it’s trying to make it useful again. The traditional marketing funnel once led people in a straight-ish line from awareness to action. AI turns that path into a personalized and context-aware conversation. Brands that view AI as the customer’s agent, not a barrier, will be the ones that thrive.

Our financial services industry report breaks down the model-specific sourcing patterns and geographic variations, helping you understand how your brand can remain visible when customers stop searching and start asking.

Read the full report to build a strategy that both humans and machines trust.