The brand visibility platform for banks

Win customers in the age of AI discovery

Win customers in the age of AI discovery

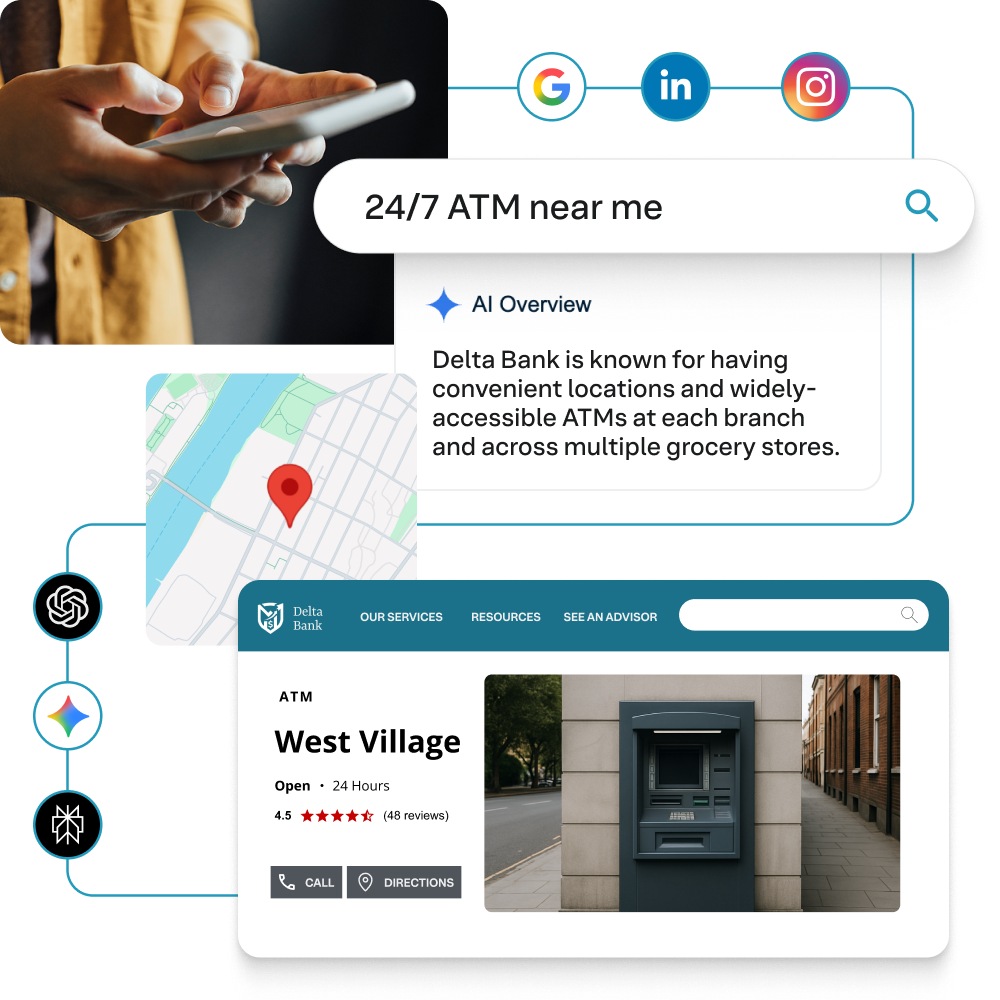

The ways customers find and choose banks are evolving from Google to ChatGPT and beyond. Yext ensures your branches, bankers, and products stand out everywhere customers search.

Compete and win in a world of AI discovery

Customers compare banks across Google, ChatGPT, maps, and review sites before opening an account. Yext ensures your branches, bankers, and products are structured, visible, and accurate across every discovery channel so you're chosen first.

Earn trust in every market

Trust drives deposits and account growth. Yext surfaces verified reviews, strengthens local reputation, and keeps product and branch data accurate and AI-ready, helping customers choose your bank with confidence.

Scale visibility without sacrificing compliance

Banks must move fast, but compliance can't be compromised. Yext provides centralized oversight, structured data workflows, and built-in guardrails, enabling branch networks and bankers to act quickly and locally while staying compliant.

Measure the visibility of your branches and products

Most banks don't see what customers do when they compare options. Scout mirrors real searches across Google, ChatGPT, and local review sites to reveal how visible your branches, bankers, and products are versus competitors, and pinpoints the fixes that will win more customers.

Structure banker, branch, and product data for AI visibility

AI search engines and comparison tools rely on structured data. The Knowledge Graph transforms your branch details, banker bios, ATMs, and products into an AI-ready format, ensuring your bank shows up with accurate, complete answers wherever customers search.

Show up everywhere customers search

From Google and Apple Maps to Yelp and ChatGPT, customers expect to find accurate details about your branches, bankers, and ATMs. With direct integrations to 200+ publishers, your bank's information updates instantly across the ecosystem, keeping you visible and trusted wherever customers compare options.

Turn reputation into a growth engine

Banking trust is fragile. Reviews influence whether customers open an account or switch providers. Yext automates requests, responses, and sentiment insights, boosting ratings and credibility in every market.

Convert searches into deposits and applications

Launch AI-optimized branch and product pages that highlight services, rates, and offers. Pages turn high-intent searches into measurable actions: new accounts, applications, and branch visits.

Empower bankers to engage on social, compliantly

Customers expect local engagement, but banks face strict oversight. Hearsay Social enables authentic banker-led social outreach with built-in compliance guardrails for safe, scalable execution.

Build relationships with compliant 1:1 messaging

Texting is today's preferred channel but risky without oversight. Relate enables secure, compliant SMS and voice so bankers can respond faster, build trust, and drive loyalty.

Provide instant answers for digital-first customers

Banking questions don't wait. AI-powered site search delivers real-time answers on accounts, locations, and services, reducing call center volume and converting more digital visitors into clients.

The Banking industry loves Yext

The Banking industry loves Yext

FAQs

FAQs

Yext makes banks visible in AI-powered platforms like ChatGPT, Perplexity, and Gemini by structuring data in formats these engines trust. Branch hours, ATMs, banker bios, and product details are published as AI-ready content across 200+ endpoints. This ensures your bank appears with accurate, reliable answers when customers ask AI tools to compare options.

Structured data ensures AI engines like ChatGPT and Google can understand and trust your bank's information. Yext transforms branch hours, ATMs, banker bios, and services into AI-ready formats. This reduces errors and increases the likelihood of your bank being recommended in customer searches.

Banks can update branch hours, product details, or disclosures in minutes. Changes sync instantly across 200+ publishers and AI platforms. This agility helps banks stay accurate during emergencies, rate changes, or market shifts.

Unlike traditional SEO dashboards, Yext combines intelligence and execution in one platform. It benchmarks performance, recommends fixes, and executes them at scale. That means faster results and less reliance on disconnected tools.

Scout benchmarks every branch against local competitors across visibility and sentiment. It highlights underperforming locations and pinpoints fixes that improve search rankings and customer trust. This transparency helps banks act quickly before issues affect deposits or relationships.

Listings make your branches, ATMs, and bankers discoverable across Google, Apple Maps, Yelp, and AI platforms where customers start their research. For banks, accurate listings are critical to capturing deposits and loans because visibility drives trust and local choice. Yext ensures consistency across 200+ publishers, giving banks the scale and control to win where customers decide.

Yes. Yext automates review collection, responses, and sentiment analysis across 80+ sites. Higher ratings and faster responses improve reputation, strengthen trust, and boost visibility in search results.

Yext empowers bankers and branches to engage on social while helping ensure compliance and brand consistency. With Hearsay Social, Yext provides bankers with the tools to publish authentic, personalized content that meets regulatory standards. This enables banks to scale trusted local engagement without increasing risk.

Yes. Relate provides compliant SMS, Whatsapp, and voice messaging for banker-to-customer engagement. Built-in guardrails and audit trails allow fast, personal communication without adding compliance risk.

Yext benchmarks visibility against local credit unions, fintechs, and regional competitors. It identifies where your bank is falling behind and gives clear actions to improve. That allows each branch to win in its community while scaling nationally.

Yes. Yext provides role-based permissions, audit trails, and approval workflows to help keep marketing execution compliant. Banks can update data, publish content, and respond to reviews at scale without losing regulatory oversight.

Yext integrates seamlessly with core banking systems and marketing tools. Data flows securely from one source of truth to multiple customer-facing endpoints. This reduces manual work and ensures consistency everywhere.

Yext supports retail banks, commercial banks, credit unions, mortgage lenders, and small business banking networks. The platform scales to manage thousands of branches, products, and bankers across diverse service lines. This flexibility ensures every institution can improve visibility, reputation, and compliance in the channels customers use to decide.

Yes. Yext is purpose-built for enterprise networks with thousands of branches and bankers. It enables centralized oversight, local flexibility, and execution at scale — all while protecting compliance and brand trust.

Recommended Resources

Recommended Resources