Analyse des données

Insights 2021 : Les requêtes longues et complexes augmentent, et les marques doivent pouvoir y répondre

2020 a eu une forte incidence sur notre comportement de recherche : sans surprise, les recherches de produits nettoyants comme Lysol et Clorox ont bondi

lchamberlain

1 mars 2021

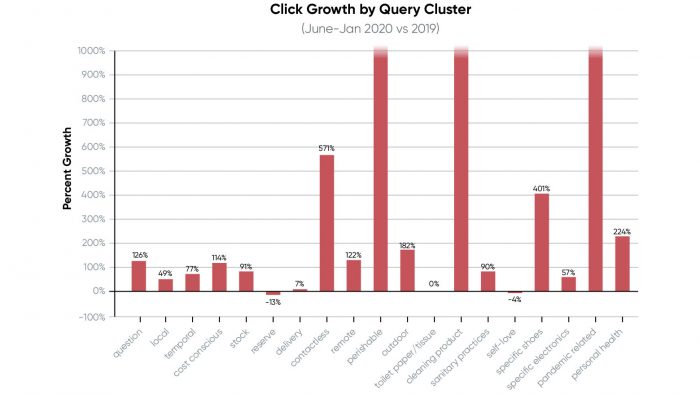

2020 had a serious impact on our search behavior: Unsurprisingly, searches for cleaning products like Lysol and Clorox went up more than 1000% — and a slew of new phrases like "case count," "vaccine," and "testing center" entered our vocabulary (and by extension, our most frequent searches).

But while we're hoping to leave some of those things behind in the near future, there's no denying that the past year has changed some aspects of consumer behavior forever.

So the question is: What searches were a just product of the times — and what kinds of search behaviors will actually remain when coronavirus is no longer a top 5 keyword?"

The Yext Data Strategy team analyzed a sample of millions of search engine queries over the last two years for hundreds of sites in a plethora of verticals to try to answer these questions. And we found out a lot — leading us to our second big data prediction for 2021: Search clicks are on the rise in several categories, and the volume of complex search queries is growing. All of this means that businesses need to be able to understand (and answer) more sophisticated user intent.

We want it, and we want it now!

We at Yext have been on the "local search" bandwagon for a long time. (In fact, we may have been driving it!) But is local search still on the rise? And if so, how different is it from Yext's 2016 pitch deck? Clicks after performing a query that included phrases signifying local intent — like "near me" — grew 49% from 2019 to the latter half of 2020.

But that's not really the big story here. The bigger change is that clicks from search engines signified much more temporal intent than local. It wasn't enough to be nearby: You needed to be open, and your hours of operation needed to be verifiable and trustworthy. Clicks on temporal queries grew 79% in that same timeframe.

But did we say what we wanted?

You got your geocoding cleaned up, you got your hours updated. Your business should be all set now, right? Wrong. The next big trend that's being carried into 2021 is increased customer questions on specific products and inventory.

Clicks to queries about specific electronics — like next-gen gaming consoles, the newest gadgets, convertible laptops, and the latest smartphones — grew 57% compared to 2019.* It could be that the marketing people at Google, Apple, Sony, and Microsoft are putting their dollars in the right place to drive up our interest levels, or it could be that these are pretty complicated products, and people need to ask a lot of questions, and do more research before buying, than in years past.

Clicks to queries on specific shoes or specific brands — like Air Force 1s or Jordans — also went up like crazy, to the tune of 401%. I'll admit, I don't totally understand sneakerheads, but they could be the progenitor of a new type of buyer: one that's more focused on getting the right product, not just any product. That means that the brands that are able to articulate what products are available, and where, will win over this bunch. With Amazon and other ecommerce-first brands putting the world of products at our fingertips, why just settle for any old pair of your grandad's chucks?

Clicks to queries about personal health and over the counter remedies understandably grew by 4x during the height of the pandemic and 3x during the back half of the year compared to 2019. But are these the types of trends that are going to survive the pandemic, or will they be forgotten as this crazy year fades from memory? (As a counterpoint, searches for toilet paper and tissues went up 16x in March, April and May of 2020 but went back to flat (0% growth) in the remaining months, compared to 2019.)

Here's the answer: The products may change, but the behaviors will not. People are going to need some very specific things, and sometimes they're all going to need it at once on short notice. Hopefully, there won't be a situation as extreme as "The Great Toilet Paper Run of 2020," but businesses that are able to answer questions about stock and inventory, spin up FAQs on short notice, and spare their employees and their customer service dollars from the chaos, will be in the best position to "win" this trend. Clicks to questions on "stock," "inventory," and "availability" of products went up 70% in the height of the pandemic, but 91% in the latter half of the year. This is the behavior consumers learned this past year, and you need to work this knowledge into your strategy for 2021 (and beyond).

How do we get what we want?

There are lots of reports on how well ecommerce is doing, but you shouldn't really need any report other than Amazon's stock price. However, you might have also noticed that you're ordering in more. Maybe you're like my mom and discovered that you can get groceries delivered to you for about the price of gas to the supermarket. Maybe you started getting something delivered that you'd never imagined you'd get delivered — like, say, your college education.

But our research is shows that brands are a mixed bag when it comes to delivery-readiness or ecommerce-readiness. Depending upon vertical, they're pulling in 75% more impressions on delivery, shipping, or general ecommerce related queries — but they're not seeing that many more clicks (7%) when compared the latter half of the year to 2019 baselines. Contactless, curbside and other pick-up related queries, however, generate a much bigger lift in clicks, +7x, in that same timeframe.

Either way, brands need to make sure their poised to take advantage of customers' needs for new types of delivery and pick-up options — and that they're able to answer their questions with truly modern search. More on this below.

Do we need to get smarter?

The last query trend we'll discuss might not be the sexiest, but it could be the most important.

As a search company, Yext's Data Strategists spend a lot of time trying to understand how search is changing, and that change is driven by how searchers are changing. Something we very frequently ask ourselves is, "are searchers getting smarter, and are they getting better at searching?" In 2000, if you were a "master googler," you knew exactly what keywords to jam into a query to get the blue link you needed. A good query might look like "mummy actor age," and it would give you a link to see Brendan Frasier's handsome face. Or, you might (try to) type in "pizza austin hours" to see your options at 2am.

But now you don't need to be "good at Google" to get information you want on the first try. You can ask Siri to "find the nearest pizza place open now," or you could ask Alexa "how old is the actor from the Mummy?" There are two things you might notice about how these queries changed: The first is that they got longer, and the second is that your query is an actual query, in the strict definition of it being a (natural language) question.

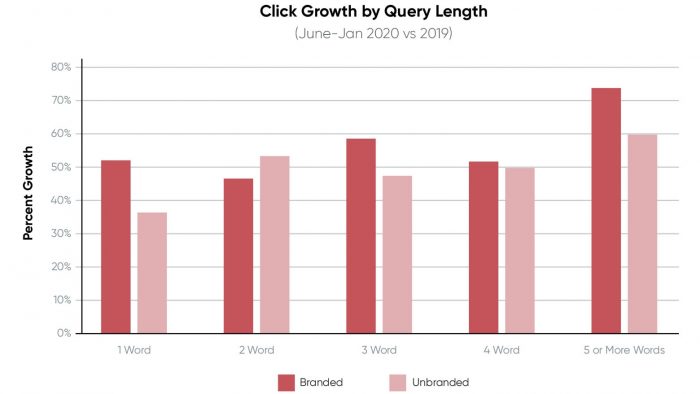

Since the pandemic isn't necessarily creating a lot of new trends, but it is accelerating most of them, both of these trackable datapoints could take a big jump forward this year. From 2019 to the latter half of 2020, people clicked on things after a question query more than twice as much (+126%), and queries longer than 5 words were the fastest growing segment in terms of engagement as well. Clicks to queries with 5+ words grew 74% and 60%, for branded queries and unbranded queries respectively, while clicks to queries with 1 and 2 words grew in the high 30s to low 50s. For additional context, total clicks to branded queries and total clicks to unbranded queries both grew about fifty percent in that same timeframe. To me, that's a pretty clear indication of a more sophisticated searcher who knows what they want — and your brand needs to be in a position to give it to them.

*Unless otherwise noted, all growths in clicks by query cluster are calculated as the average monthly volume in Jun-Jan 2020 vs. the average monthly volume in all of 2019, in order to get a picture of what query trends survived the height of the COVID-19 pandemic.