Drive Better Customer Engagements in Financial Services with a Modern CMS

Drive Better Customer Engagements in Financial Services with a Modern CMS

Learn how your financial services organization can gain a competitive advantage by augmenting your existing CMS.

Why A Modern CMS is Headless — And How It Supports a Composable Martech Architecture

1. A headless CMS delivers information to clients faster

2. Storing information in a headless CMS gives teams agility in creating new experiences

3. A headless CMS is compatible with the rest of your martech stack

The last few years have brought increased levels of uncertainty in real estate, insurance, banking, and capital markets. This volatility isn't predicted to slow down — especially as geopolitical unrest and economic challenges caused by inflation, supply chain disruption, and recession fears grow.

These challenges are industry-wide — and it falls to marketing and technology leaders to solve them. They need to deliver a better customer experience in a challenging macro environment, all while managing risks and regulations.

A great experience for customers today sets the bar – and their expectations – for all future experiences. But what is the underlying technology of these great experiences? A content management system, or CMS.

But which CMS is best for the financial services industry – and how do you decide?

Why A Modern CMS is Headless — And How It Supports a Composable Martech Architecture

Traditional CMSs only manage traditional online experiences, like your website. To create the experiences that customers expect today, financial services organizations need to transition their technology into the future.

That's why many organizations are moving away from a traditional, or monolithic, CMS. Instead, they invest in a headless CMS. A headless CMS supports a composable architecture, meaning that it's easier to build dozens of experiences for customers (as opposed to only website experiences).

One of the key differentiators of a headless CMS is its ability to manage content across a diverse set of channels. This includes your website of course, but it also helps you manage mobile apps, chat, search, and third party experiences (like those on Google, Facebook, Apple, and Amazon).

For financial services organizations, the headless CMS extends even further into connected applications like appointment schedulers, data visualization platforms, CRMs, ERPs, and core insurance and/or banking systems.

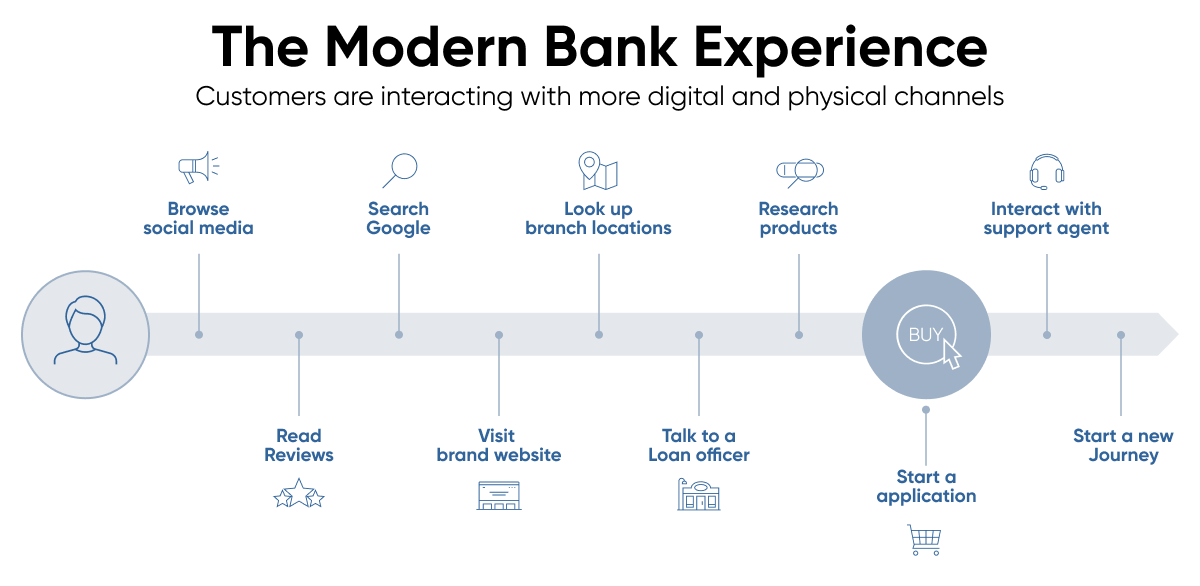

Here's an example of a customer journey in the Financial Services industry.

Here's an example of a customer journey in the Financial Services industry.

A headless CMS is the foundation of a composable marketing technology stack. It allows users to manage digital channels by working with their vendors of choice to augment their abilities. Financial organizations can also augment monolithic CMS platforms by ingesting and consolidating data — this makes for an easier transition away from legacy technology.

This flexibility is important – here's an example:

Many mergers and acquisitions take place in the financial services industry. Even if the acquiring organizations wanted to replace these legacy systems, it takes time. A headless CMS offers faster information to your clients, agility to create new experiences, and interoperability to maximize the use of everything in the martech stack.

A headless CMS powers experiences across many first- and third-party channels. To do this successfully, here are three modern headless CMS must-haves.

1. A headless CMS delivers information to clients faster

Your headless CMS works within your martech stack to deliver content and information quickly – without compromising on accuracy or experience. It does this by consolidating all information into one platform for easier management, and then syndicating that data across every digital experience.

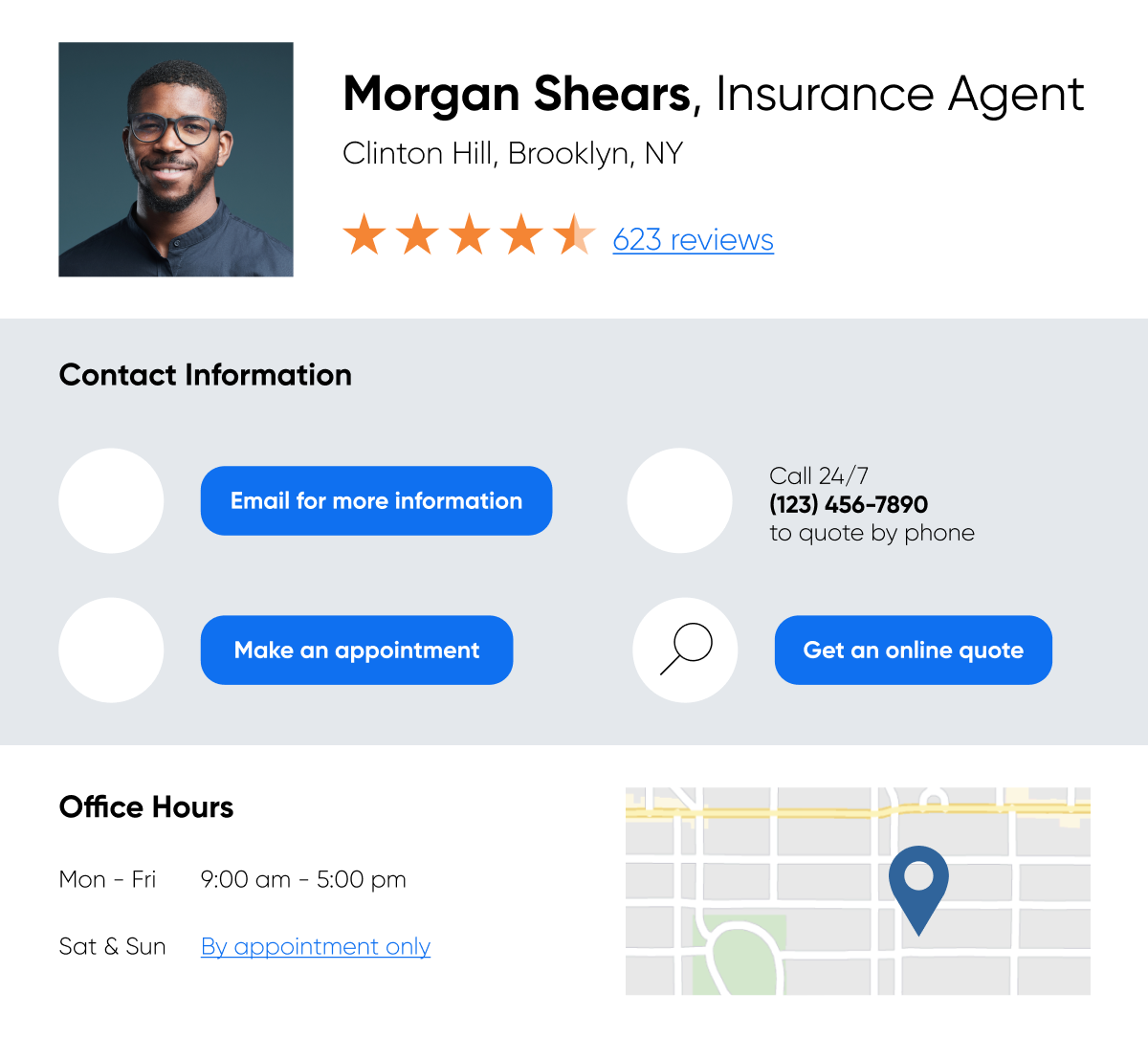

Let's look at an example. Here, we have a top insurance agent named Morgan Shears.

Morgan is an agent for an insurance agency, and when his clients search for his profile, they see lots of information there. But that information isn't just on his profile — it's also on his listings, embedded in his reviews, visible on his social media profile, and more.

Consider all the information that Morgan needs to manage across each experience. He needs to show her clients:

- A high quality image so clients can humanize the person they're working with

- His name

- His biography

- The licenses and certifications he carries

- His office location(s)

- A map to his office location(s)

- His hours of operation for each location

- Reviews from his other clients

- His phone number, email address, and any other relevant contact information

- Calls to action

- Any disclosures

- And much more

To create seamless online experiences for her clients, Morgan needs to manage all of this information on his owned, first-party channels, like his website. But he also needs to manage these online experiences on non-owned, third-party channels like his listings, his social media profiles, and more. This is the value of a headless CMS: it allows Morgan to manage all of these channels from one single platform.

Behind every great customer experience is a great agent experience. The technology used by agents like Morgan to manage first- and third-party channels needs to be easy to use. It should guide the agents and their teams through a series of steps to support them, and it should provide insights on what they can do to improve their experience. It should have oversight and supervision workflows, and it should adhere to SEO and regulatory standards.

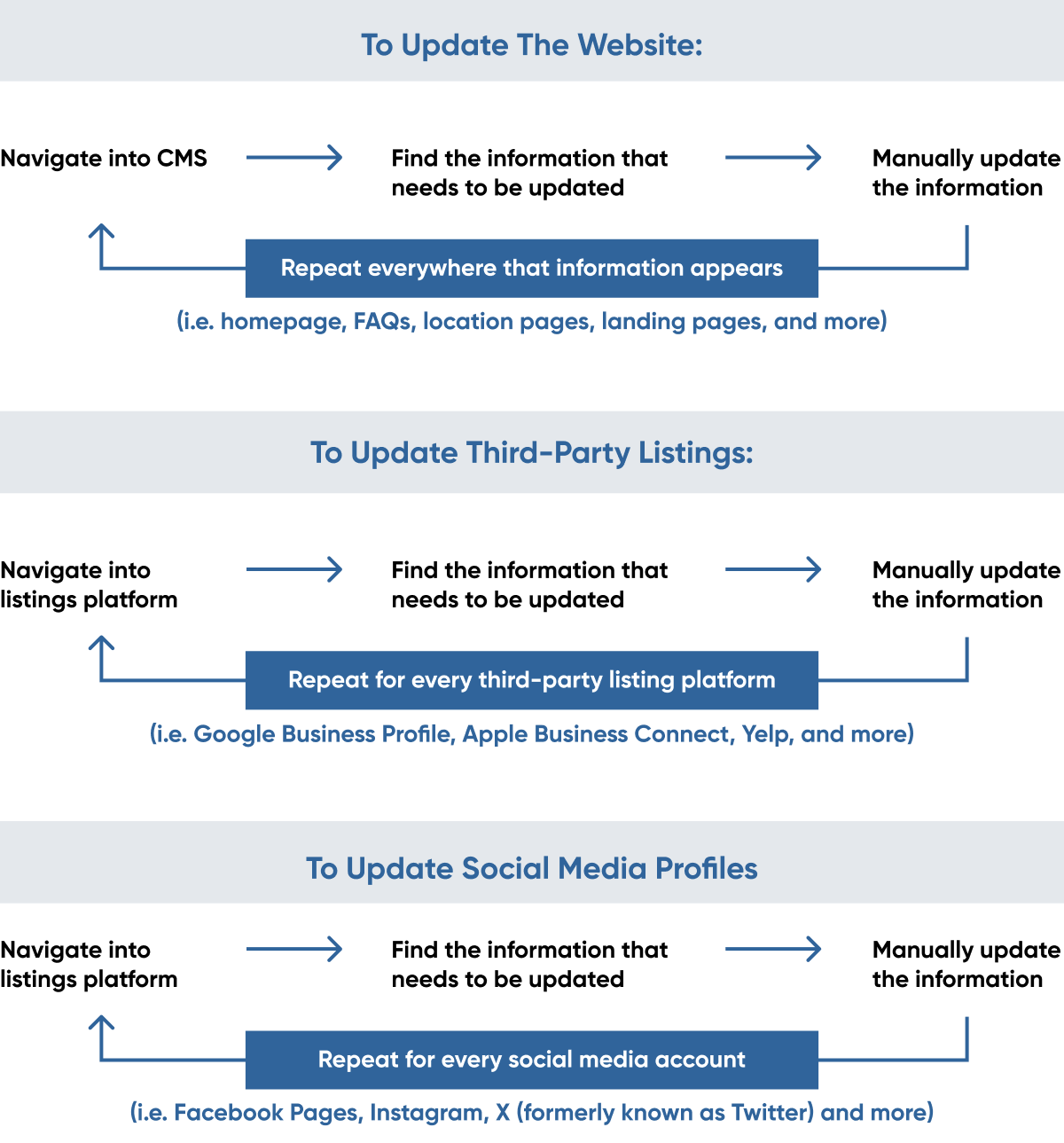

Here's how Morgan would have to manually update his information in a traditional, monolithic CMS:

Now imagine a storm is coming and you need to change every agent's profile within the storm's location to update their hours of operation. Or, maybe you want to update disclaimers for all agents with a CFP because of the relatively new SEC Marketing Rule for major or minor awards. It's not enough to update this information on a website alone — these changes must be reflected across all channels.

These are the changes that bring traditional, monolithic CMS platforms to their knees. It's too difficult for agents to manage so much information, there are no brand or admin controls, and the work is extremely slow and manual.

But with a headless CMS, agents can deliver the most accurate content faster. In a headless CMS, they can bulk edit information, create their own workflows, and even schedule the changes to happen at a later date.

2. Storing information in a headless CMS gives teams agility in creating new experiences

Where a traditional, monolithic CMS only manages a website, a headless CMS can manage all owned and non-owned channels — including ones that have only just started to take shape.

As customers turn to technology for more self-service, they're having more conversational experiences: with chat, search, voice assistants, and more. A headless CMS supports — and optimizes — these experiences by structuring data so it's easy to find across the platform... and every channel the platform supports.

Because customers prefer omnichannel experiences, financial services organizations need to provide accurate, consistent information across channels to deliver that seamless journey and experience. A headless CMS allows you to store, manage, update, and then syndicate that information across all owned and non-owned channels. This includes both first-party experiences (like your website and apps) and third-party experiences (like listings, social media, and reviews on platforms like Yelp).

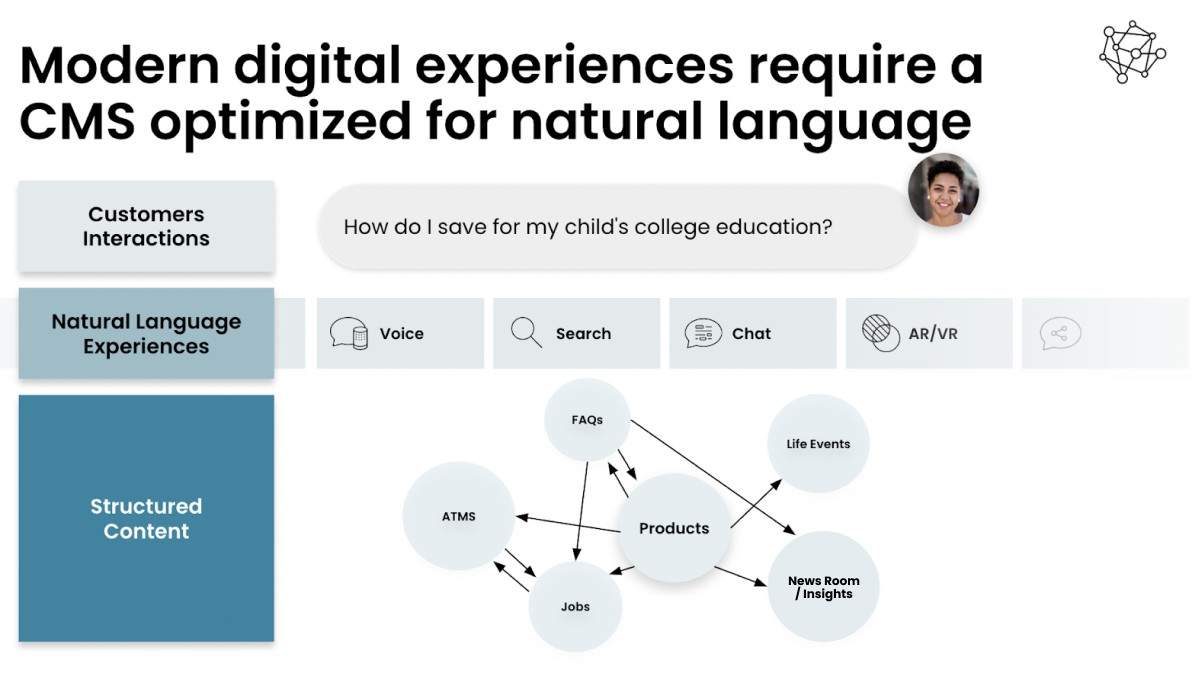

The information in your headless CMS can be modeled in a structured format, so it's easy for new and emerging technologies to reference. The headless CMS also supports various types of content, ranging from web, chat, to voice, too.

Additionally, a headless CMS with natural language abilities can use intent to map a life event. In this example, the voice, search, chat, and AR/VR channels can map the object in question (a child's education) to financial products (a 529 plan). Then the technology can give the client helpful, specific resources.

Content, Yext's headless CMS, will store information and map it to related information. As an example, it can map information on individual agents with their specialties, proficiencies, locations, and more. Then, when the client searches for something specific on an owned or non-owned channel, such as an advisor that specializes in young families, speaks Spanish, and is located within 5 square miles of their destination - they'll receive specific relevant information.

Customers shouldn't have to follow a linear journey — and with the rise of omnichannel experiences, they often don't. Because up-to-date, accurate information is what clients expect, it's important that it's easily managed in one central platform before syncing that data across first- and third-party experiences.

With a headless CMS, financial services organizations are empowered to manage their information from one single platform — and gives them a competitive advantage when it comes to visibility across channels.

3. A headless CMS is compatible with the rest of your martech stack

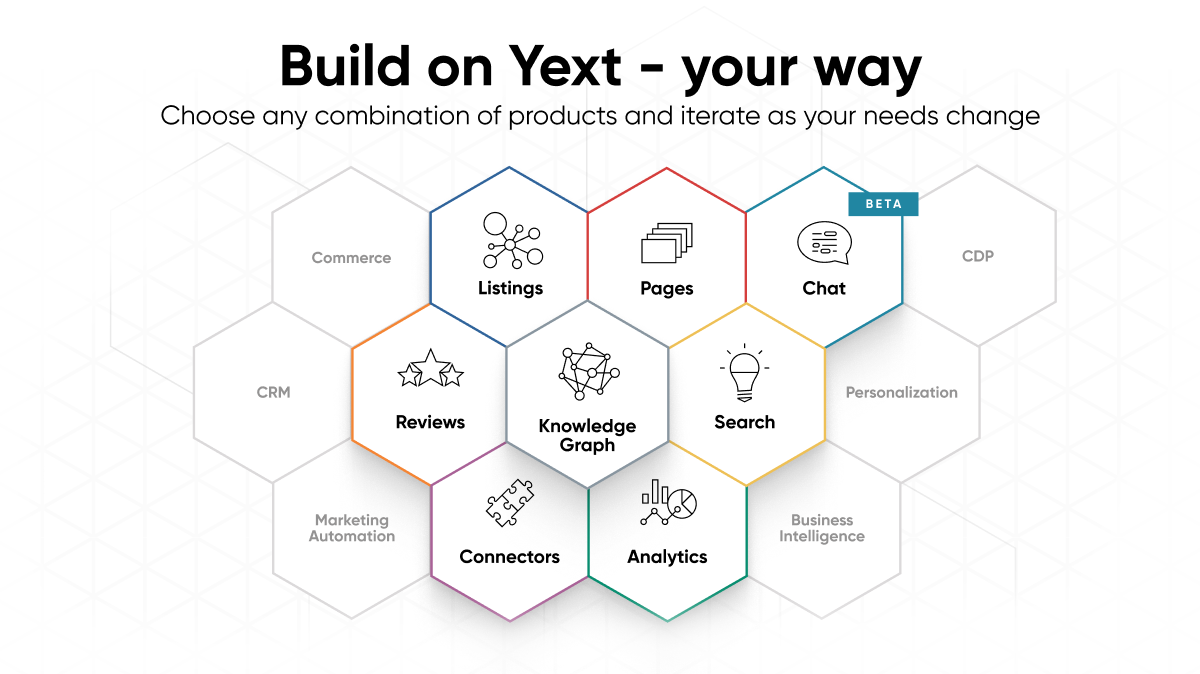

Finally, a headless CMS's greatest strength is that it gives financial services organizations choices. They can augment their existing martech stack. They can consolidate their tools. *They can even do both at the same time. *

This flexibility is by design — that's the strength of a composable architecture. As times change, the martech stack can evolve, too. And as the foundational piece of this architecture, the headless CMS is key.

In a composable architecture, each solution is independent of the other solutions in your martech stack. This enables your organization to manage and scale channels at a pace suitable for your resources and goals.

Rather than committing to one legacy content management system – or 100 individual solutions like your CRM, core banking platform, CDP, and marketing automation platform – a headless CMS in a composable martech stack eliminates overreliance on one vendor, and makes it easy to bring in new solutions. You can use multiple vendors and solutions to manage and improve experiences all throughout the customer journey.

For example, Yext Content integrates with most other martech solution via an API. This allows organizations to build their own custom martech stack — even if they choose to use solutions from other vendors like Adobe, Salesforce, Sitecore, Marketo, and more. As a certified member of the MACH Alliance, compatibility with your favorite vendors and solutions allows you to create a completely customized techstack. The result is better visibility into (and control of) first- and third-party experiences.

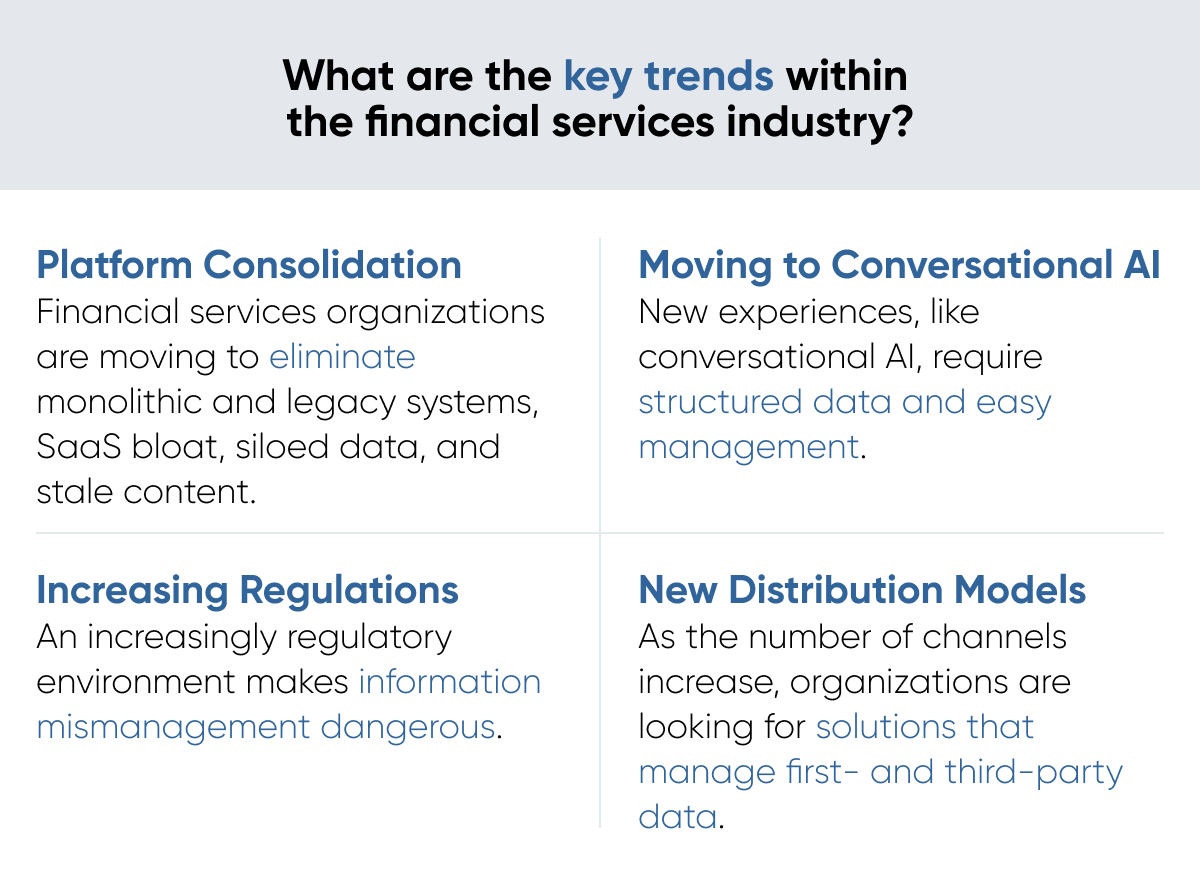

As time marches on and new technologies are introduced, the headless CMS's interoperability makes it a timeless tool. And while its longevity extends its usefulness well into the future, the headless CMS can also help financial services organizations capitalize on key industry trends today.

As these trends evolve — and new ones emerge — the headless CMS remains key. Why? Because it serves the needs of the organization and improves customer experiences with accurate, available information.

Conclusion

By investing in a headless CMS now, financial services organizations gain a competitive edge today and set their teams up for success tomorrow. This composable approach to your martech stack improves experiences for your customers — and will for years to come.

And even though the financial services industry faces unique challenges (like changing regulations) the headless CMS empowers organizations to use new and emerging technologies, like AI and LLMs.

This isn't just theoretical, either. Organizations like First Financial Bank are using a full suite of composable products (anchored by their headless CMS) to create seamless experiences for their clients. And the numbers reflect their success: First Financial experienced a 225% increase in site search volume and a 27% click-through rate in search results.

And they aren't alone. Financial organizations everywhere are choosing to embrace these changing times — and they're doing it with a fresh, new mindset on technology's role in the customer experience.