Generational Preferences: Analyzing the Impact on the Customer Journey

Generational Preferences: Analyzing the Impact on the Customer Journey

Dive into the differences in how Gen Z, Millennials, Gen X, Baby Boomers, and the Silent Generation engage with brands across digital channels, from discovering products and services to making a purchase.

Customers are relying on more digital channels than ever before to find information. They ask questions on search engines, read reviews across platforms, engage with locations on social media, and use AI tools like ChatGPT. And with 94% of customers* looking for information beyond major websites like Google, Bing, Facebook, and Apple, their journey is more varied than ever.

While this is true for customers of all ages, there are important generational differences marketers need to understand. Yext conducted a Digital Customer Journey survey to quantify how customers from each generation interact with brands and make buying decisions.

Here's what marketers need to know about generational preferences in order to reach and engage with more customers.

Here's what marketers need to know about generational preferences in order to reach and engage with more customers.

1. Discovery

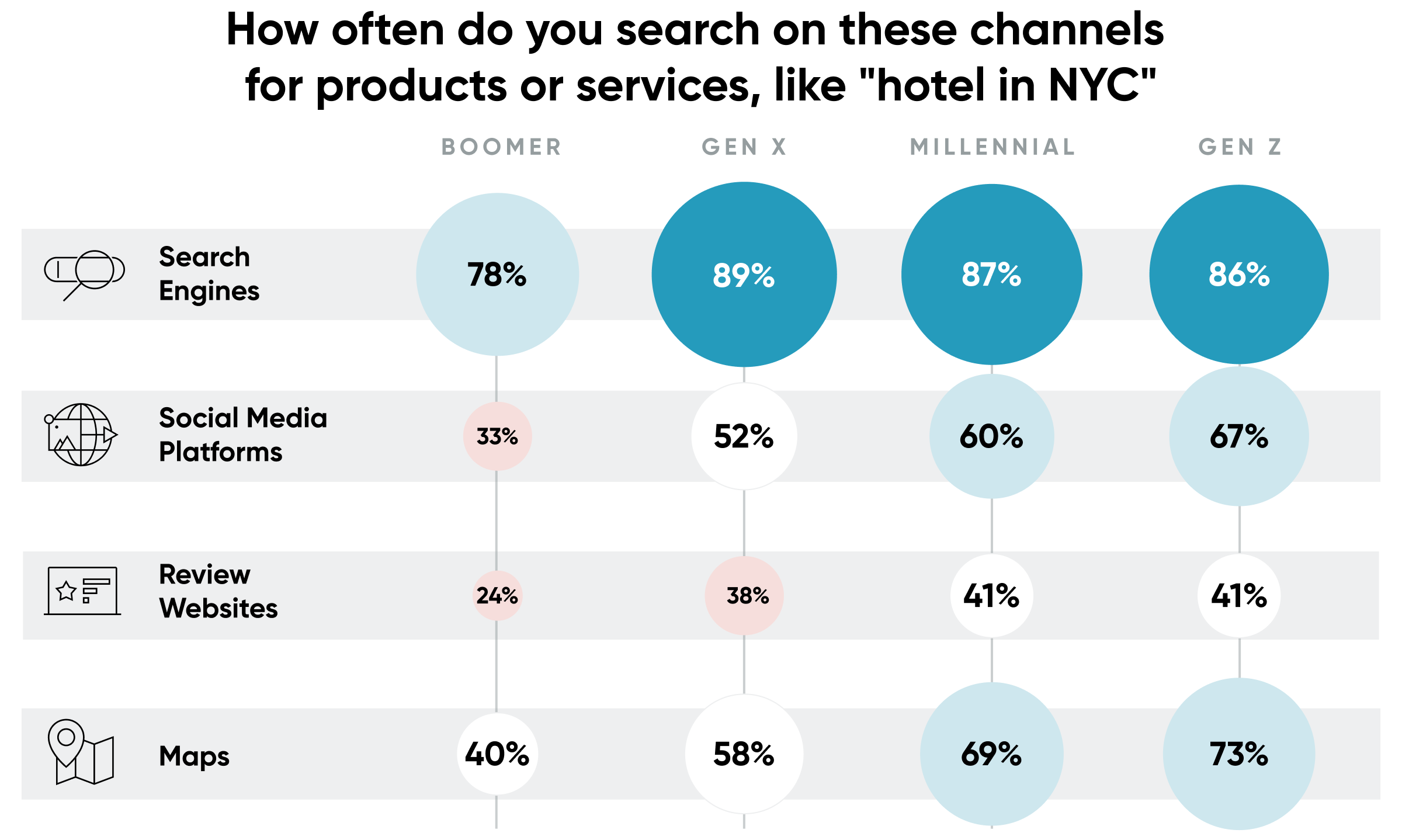

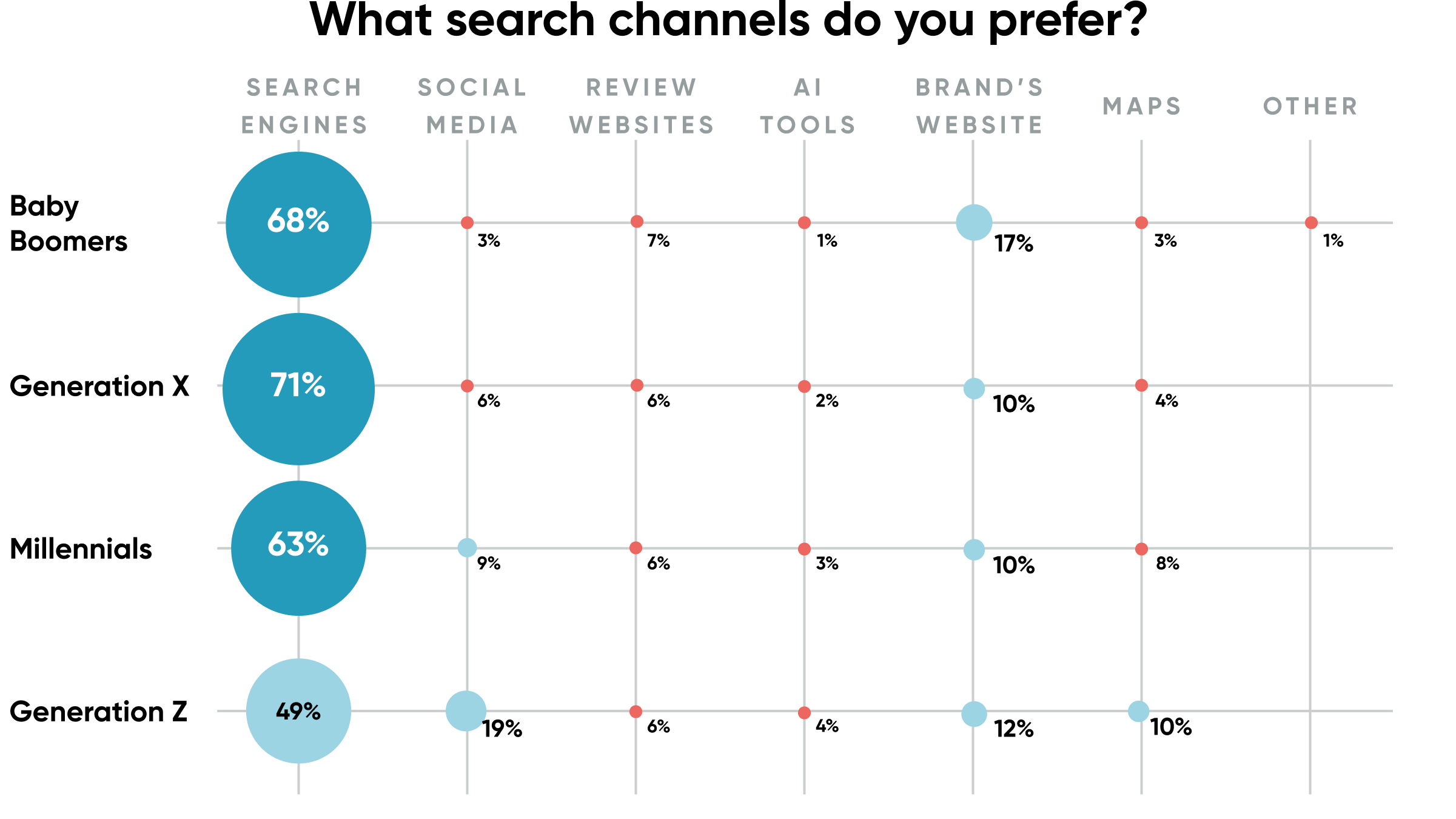

It's not news to marketers that customers of all ages research products and services online — and across a variety of touchpoints. But how does that vary based on age group? The chart above shows the generational breakdown.

It's not news to marketers that customers of all ages research products and services online — and across a variety of touchpoints. But how does that vary based on age group? The chart above shows the generational breakdown.

Here are the top three takeaways:

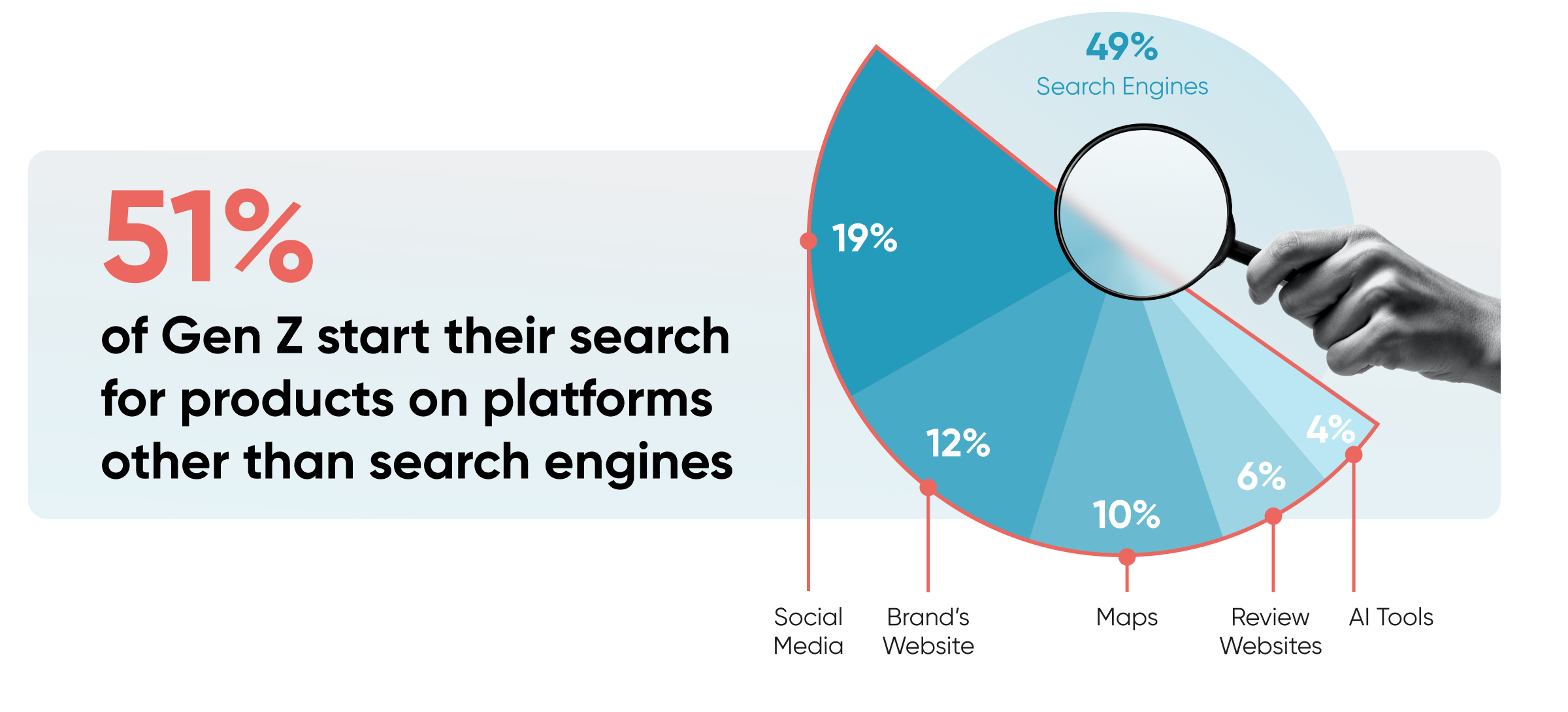

- The search landscape is most fragmented for Gen Z: the majority of each generation starts on search engines, but more than half (51%) of Gen Z start on other, non-search platforms (hint: social media is a major factor). Search is more fragmented than ever for younger users.

- Search engines are important for all cohorts, but Baby Boomers (68%) and Gen X (71%) use them more often compared to other generations.

- Often overlooked, maps are important to a significant number of customers: Millennials (8%) and Gen Z (10%) use maps (like Google and Apple Maps) more often than other generations.

2. Consideration

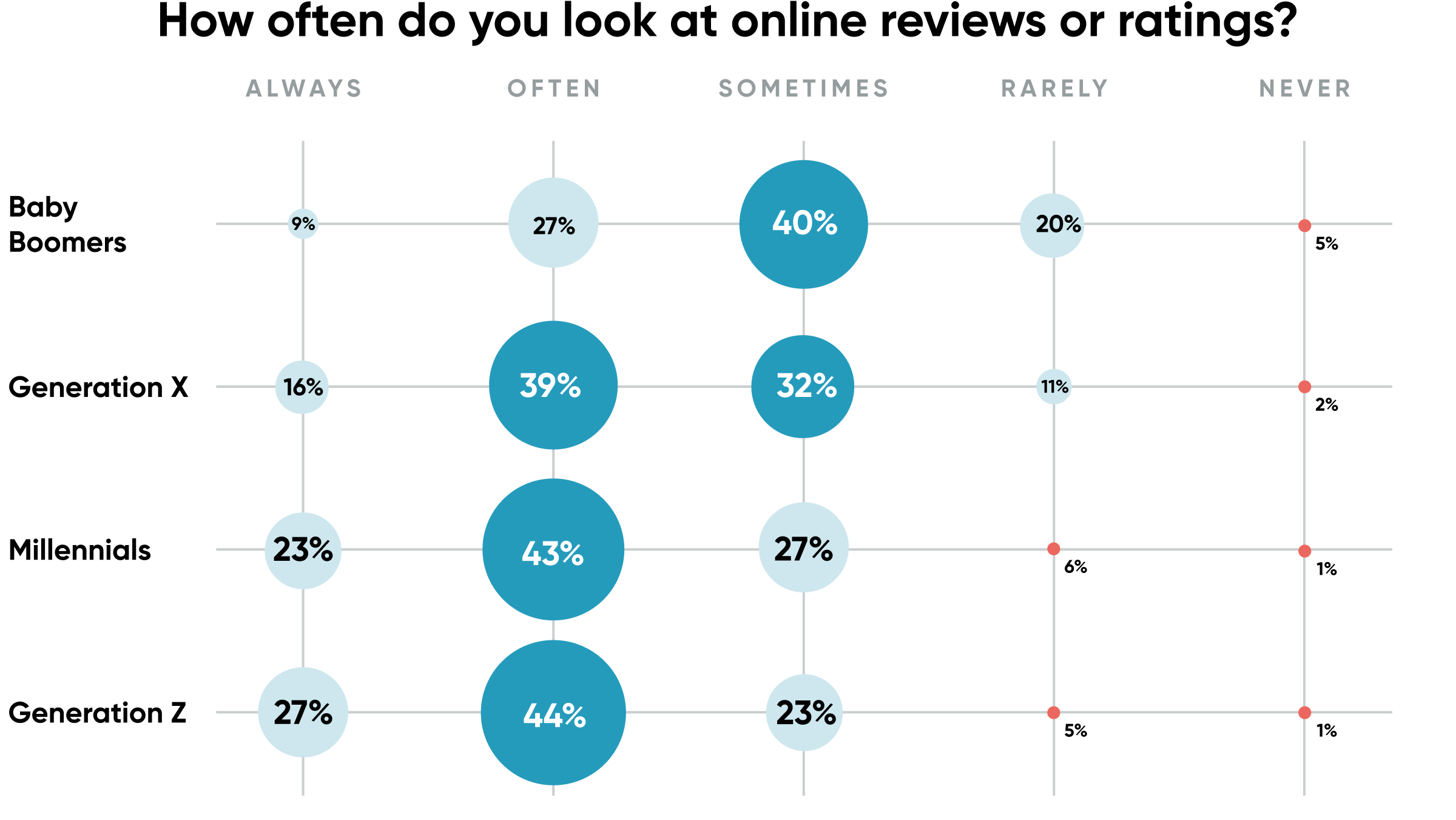

Once customers reach the "consideration" phase of their journey, they're looking at reviews. Online reviews are an important part of any brand's digital presence, but this chart above shows how different generations evaluate them.

Once customers reach the "consideration" phase of their journey, they're looking at reviews. Online reviews are an important part of any brand's digital presence, but this chart above shows how different generations evaluate them.

Social channels matter, too. Gen Z, Millennials, and Gen X in particular use social media to evaluate — and engage with — brands through their journey.

The key takeaways:

- The younger the generation, the more frequently they evaluate online reviews or ratings: the majority of Millennials (66%) and Gen Z (71%) "always" or "often" look at reviews before going to a physical store or restaurant. Sliced another way, only 13% of Gen Z, 7% of Millennials, and 7% of Gen Z do not look at online reviews — compared to 24% of Boomers and 52% of the Silent Generation.

- Brands shouldn't overlook social media in the consideration phase. Unsurprisingly, Gen Z uses social media the most: this cohort uses all social platforms more than other groups except for Facebook and LinkedIn. They primarily over-index on using Instagram (71%), TikTok (66%), and YouTube (58%).

- Brands may see success using Facebook to reach customers in their 30s, 40s, and 50s: Generation X (57%) and Millennials (60%) use Facebook more often than other generations — meaning that brands shouldn't forget about Facebook in this journey phase (even though it might be considered "less cool" by younger users).

3. Decision and Loyalty

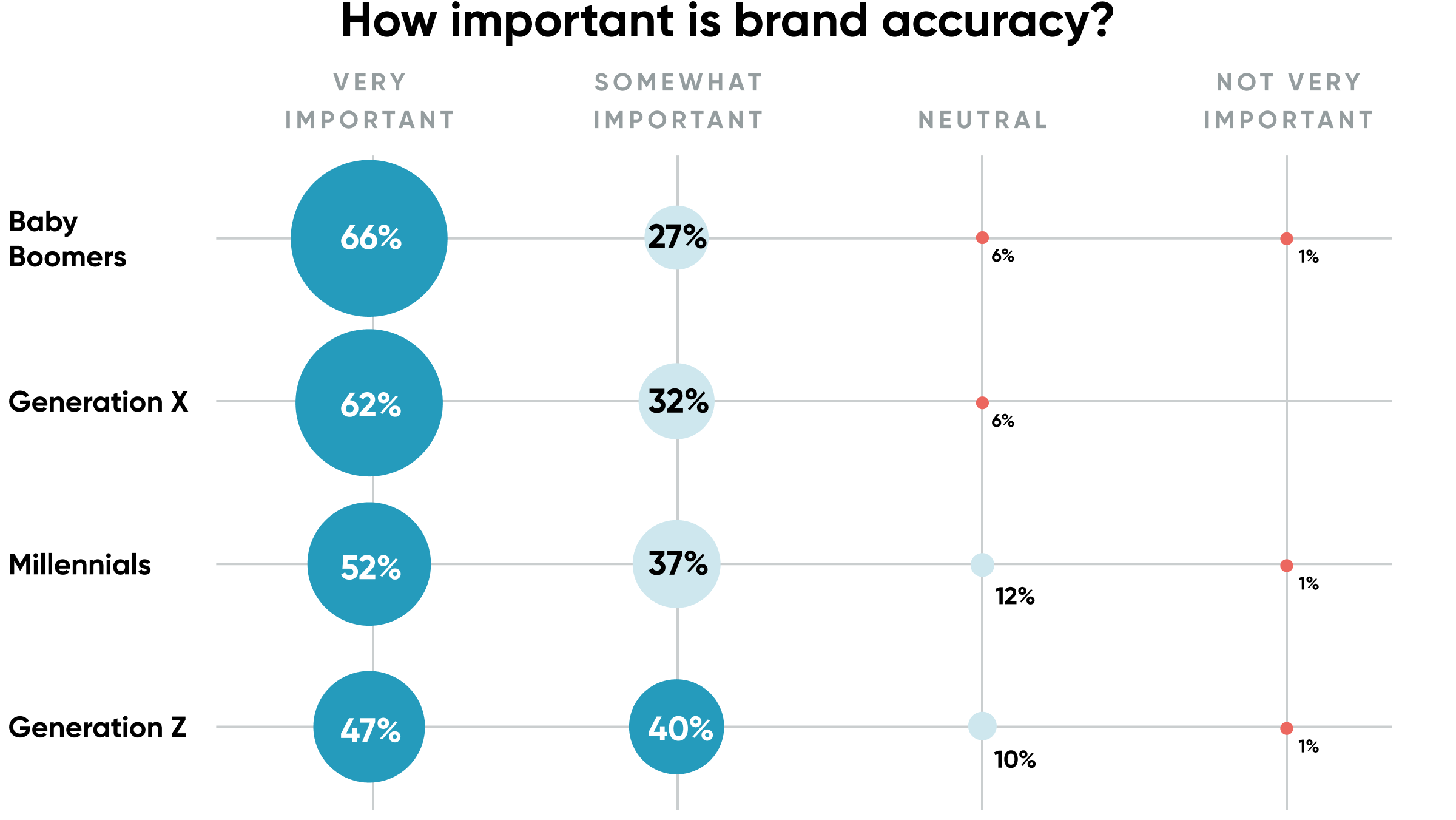

By the time a customer reaches the "decision" stage, they've evaluated a brand's presence on search, social, reviews, and more. But when it comes to making a purchase, what's most important to them? Accurate and useful information, per the findings above.

By the time a customer reaches the "decision" stage, they've evaluated a brand's presence on search, social, reviews, and more. But when it comes to making a purchase, what's most important to them? Accurate and useful information, per the findings above.

The key takeaway:

- Every generation values accurate brand information across channels: 100% of the Silent Generation and 99% of each other generation say it's "very important" for a brand to have accurate information when they make a purchase decision.

Brands have a significant opportunity to win business by delivering robust, accurate information across every channel someone might use to find information — regardless of their age.

That said, what's considered a "trusted source of information" might be shifting thanks to the younger generations. Gen X still trusts more traditional sources of information like search engines and brand websites, but Gen Z isn't as bought in. Take a look:

That said, what's considered a "trusted source of information" might be shifting thanks to the younger generations. Gen X still trusts more traditional sources of information like search engines and brand websites, but Gen Z isn't as bought in. Take a look:

The key takeaways:

- "Traditional" digital sources like websites and search engines are trusted by middle generations: Gen X is the most satisfied with the information on search engines (89%) and brand websites (83%) compared to other generations. Gen Z is the least satisfied (79%) with information on search engines compared to other generations

- Younger users are more comfortable with AI: over half of Millennials and Gen Z (51% each) are satisfied with the accuracy of information from AI tools

- Social media is trusted by younger users, and accuracy there counts: Millennials (65%) and Gen Z (72%) are satisfied with the accuracy of information on social media

These differences simply reinforce the need to have accurate information everywhere — and "everywhere" looks a lot different than it once did. Gen X's "trusted source" might look a lot different than Gen Z's, and brands need to be prepared to deliver. Otherwise, they'll miss an opportunity to meet customers where they are and build trust in their brand.

Conclusion

Across the board, our survey shows that customers are using diverse sources — from search engines to social media — to research brands throughout their journey. Across generations, they demand accurate and useful information everywhere, reinforcing the importance of a broad digital presence.

That said, marketers have a significant opportunity to engage more young users in particular on platforms outside of "traditional" search engines. Thus, mastering the digital customer journey in 2024 means not limiting marketing efforts to "traditional" SEO, or over-focusing on any one touchpoint.

Ready to dive in further?

*Survey details: The results are from an online survey of 2,312 adults who purchased something online within the past year. The survey was conducted from June 14 to 25, 2024, by Researchscape International on behalf of Yext. Results were weighted by country population, age, and gender. Respondents were from five countries: France, Italy, Germany, the United Kingdom, and the United States.