Unlocking the Power of AI in Financial Services

Unlocking the Power of AI in Financial Services

AI is here to stay — so let's dive into the ways the financial services industry can take advantage.

In 2024, we are expected to create 147 zettabytes of data. (For those that don’t know how to quantify a zettabyte of data, one zettabyte is as much information as there are grains of sand on all the world’s beaches. Multiply that by 147x, and that’s how much data we’ll create this year.)

In other words, we're facing an explosion of data — and it's only just begun. Consider this growth trajectory: in 2010, we only created 2 zettabytes of data. Today, we stand to generate more than 73.5x that amount this year alone.

This eruption of data creates a challenge for brands — and especially in financial services.

In the past, customers walked into a physical branch or insurance agent's office, and there were only so many options — and only so many signals competing for the customer's attention. Now, customers can read online reviews, scan product comparisons, and determine the place to get the best offerings even before they leave their couch. We compete on so many fronts to win each customer's attention, trust, and loyalty.

Today, customers search for — and find — more information than ever across an exploding number of digital touchpoints. Financial services and insurance brands need to keep all of this information correct and consistent, while also structuring it in a way that allows them to personalize the answers to complex customer questions online.

The good news? With rapid advances in AI, businesses have a new tool in their toolbox — provided that they can learn how to properly take advantage. Today, large language models (LLMs) can answer sophisticated questions and provide information to resolve problems.

1. Answer more user questions — by structuring your information in a way AI can understand

In today's world, much of the data financial services organizations produce is designed for specific channels (social, platforms like Google Business Profile, etc.) — and it's not "meaningful" or intelligible for other channels like web, chat, voice, and more. There is no way to reuse this information for new purposes because none of the technology talks to other systems. (For example, banks power ATM data on Allpoint, but they don't have a great way to syndicate that information elsewhere, like on third-party sites such as Google.)

Instead, organizations need a meaningful way for AI systems to understand their business and answer complex questions — which is not possible by just indexing a webpage for keywords.

With the rise of AI, the opportunity for organizations to speak to consumers and/or their employees will move beyond the indirect world of updating these third-party platforms, to a more direct, two-way interaction. But in order for this to happen — i.e., for AI to be able to answer business-related questions — it needs to be able to draw on all of a business' facts and information in a centralized, organized place.

In other words, businesses will need to organize their information into a single platform that is built to power knowledge on these third-party experiences as well as AI interfaces. This serves as a platform that is designed to "feed" answers to AI systems that can actually "converse" with customers — while still allowing businesses to maintain human control and oversight over exactly where each answer originated. (When we talk about "AI systems" here, we're talking about the wide variety of first and third-party experiences, like social sites , voice assistants, mobile, web app, chat interfaces, and many more — that consumers interact with every day.)

Here's an illustration of information structured with bi-directional relationships so that AI interfaces can "understand" it and draw on it.

With this understanding, organizations can start to organize their information more effectively — storing it in a way that allows them to engage in conversations with customers across different channels. The future is technology that can talk back to people and other systems.

The good news? Once you have your information organized this way, managing and updating it is an order of magnitude easier to maintain than with the "old" way, with facts siloed across channels.

By storing all of the content about your organization in a platform that is well connected via entity relationships, not only will AI models be better equipped to answer questions about your brand, but content updates will be seamless and easier than ever.

(For example, with Yext, if you delete a page — e.g. a Loan Officer Page — you won't have to clean up broken links to other webpages like branch pages. The identity provider system can notify the graph of updates, so humans don't need to delete or/add this type of content. Click here to learn more.)

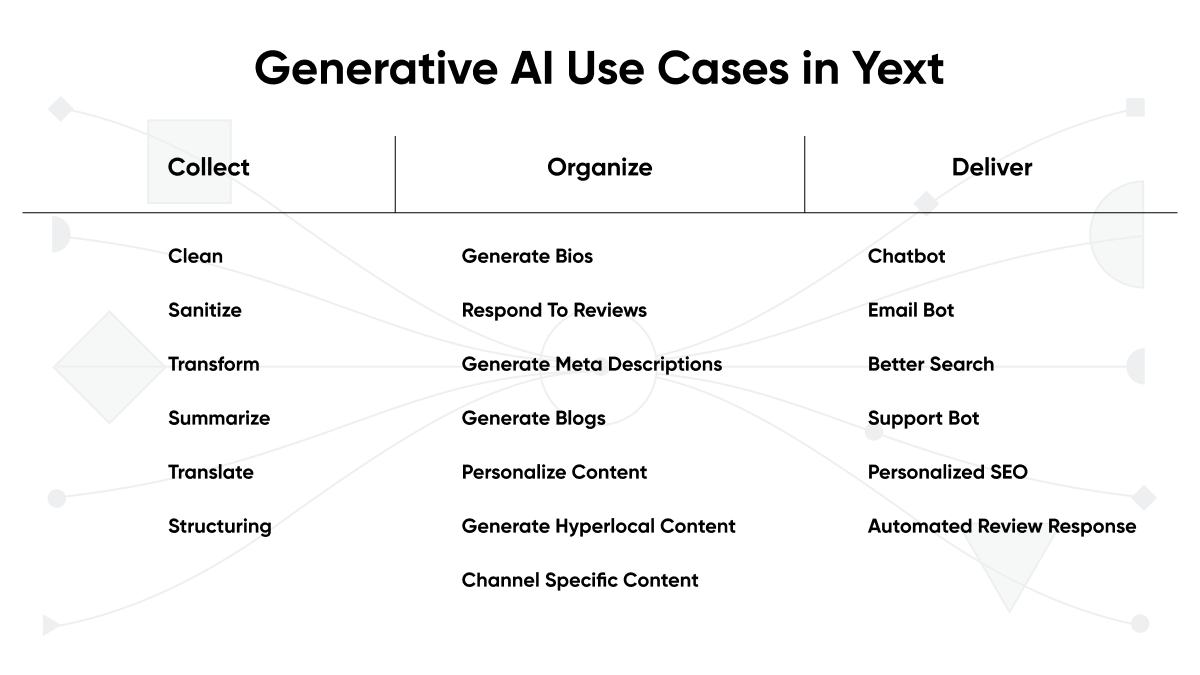

AI can take several forms. Conversational AI engages directly with a user, typically via a chat-like format. It’s the ideal AI for giving personalized responses to user questions. Generative AI is better to create new content from an existing repository of information. This AI is often used to write webpage copy, generate bios for financial professionals, and pull important information out of long-form resources.

AI can also answer hundreds of complex questions from a simple graph. For example:

- Find a mortgage officer near me that is available now? (Intent to find a mortgage + location intent + time intent)

- Best mortgage loan officer near me? (Mortgage intent + reputation intent)

- Can you send me the driving directions of a branch? (Branch intent + location intent)

Because AI can be adapted to the user's needs and preferred channels, it shares information in ways that have been hard for the financial services industry to achieve — until now. Use cases for AI in financial services range from converting new prospects to providing support options to existing customers.

Consider this scenario: a prospect is engaging with a bank for the first time. They want to know what investment vehicles the bank offers. By combining the structured data in your platform with the power of AI, the bank can provide a company-verified answer in a personalized, conversational format via chat. And because the bank has control over its data, the AI tool can do this safely and compliantly.

AI can still improve customer interactions even if it’s not customer-facing. Let’s say that the bank isn’t ready to fully hand over customer interactions to AI. AI can also be used internally, to support account services and customer support teams. When a customer calls into the support center with a question, the support agent can use the AI to find internal resources more quickly, condense the relevant information – and answer the customer’s question more quickly, too.

As you think about optimizing your digital experiences for AI, below are some simple steps for the AI-empowered marketer:

1. Think about the questions your customers have — and what entities/content you need to be able to answer these questions:

- Products/services: this could be credit cards, insurance products, or offerings like wealth management for high networth vs mass affluent

- Branches: you could have different types of branches (ex. digital branch, micro branch, full service, advisor, speciality branches, popup branches)

- FAQs: often this is how-to information like "resetting a password" or "signing up for online banking"

- Financial professionals: mortgage, wealth, business bankers, insurance agent, etc.

- Announcements: merger, new branch openings, catastrophic events (for example, when branches need to close down in certain areas during a hurricane)

- Offers: they are usually associated with a product or territory

- Disclaimers: broker checker, state licenses, SEC, FINRA, etc.

2. Map out what data you need to know about these people, places, and things: phone numbers, addresses, hours of operations, reviews, languages spoken, rates, product descriptions, images, license numbers, and lots more.

3. Identify where you will get all of this information: ERP, LOS, Core Banking Platform, or your CMS — to name a few options

Now that we understand all the facts about your business — and why they need to be structured in a way that can be combined with an AI interface — let's explore the value of new AI possibilities for marketers, like content generation.

2. Take advantage of AI content generation

If you take a look at the Harvard Business Review's definition, content generation refers to the process by which: "large language and image AI models can be used to automatically generate content, such as articles, blog posts, or social media posts. This can be a valuable time-saving tool for businesses and professionals who create content on a regular basis."

Essentially, AI models today are powerful enough to serve as advanced "writing assistants," creating informative, readable copy in a matter of seconds — provided they have the right inputs. (You probably already know this if you've ever played around with the likes of Jasper or ChatGPT).

That said, there are several important considerations for financial services organizations looking to adopt an AI content generation strategy. Two key starting points are:

- Determining the types of content that suit an AI approach

- Ensuring that you're basing content generation on fact-based inputs that you control

If your organization needs to spin up simple, digestible content quickly — but lacks the bandwidth or resources to do it the "old-fashioned" way — AI content generation is an incredible asset: it's quick, cost-effective, and scalable. Further, it can work with your current approach to creating content as an accelerator or a supplement — not a replacement.

There are certain types of content that are best suited for AI content generation. Content generation works wonders for creating copy for financial professionals' bios, event descriptions, FAQs, webpage metadata, and sometimes even blog posts. (Essentially, shorter, informative assets that are fact-based, rather than opinion-based.)

The second piece of the equation is that the inputs used to generate the content — the names, dates, essential facts, and more — need to be 1. controlled by your business and 2. intelligible to AI systems (just like we talked about in section one — it's all connected).

It's with both of these pieces in mind that we launched Content Generation at Yext.

To get a little bit more specific there, let's look at some of the use cases within Financial Services for AI Content Generation.

Let's dive into one example: generating bios for financial professionals. Traditionally, this process can be tedious and time consuming.

But when your information is stored with Yext —in the way we described in section one — we have all of the information about the languages a professional speaks, the communities they serve, the products they are licensed to sell, their address, hobbies, and who they are targeting (like business owners, or high-tech individuals). These facts can be entered into AI Generative Models to generate a bio in seconds for thousands of financial professionals.

Example inputs: :

- Speaks Spanish, Zip code 95050, Award President club, Product - business insurance, Jane Smith, 12 years of experience.

BIO:

"Jane Smith is a highly accomplished insurance agent, known for her fluency in Spanish and expertise in serving the Santa Clara market. With 12 years of experience in selling business insurance, Jane has earned a reputation for providing top-notch insurance solutions to her clients. She is also a member of the President Council, a prestigious group of business leaders."

This is just a simple example, and the capability exists for fine-tuning to a specific brand voice or to understand brand names. Click here to learn more.

When you combine AI content generation with structured data in the Yext platform, you can scale your content across more digital touchpoints. Generated content can help improve your return on SEO efforts, increase visibility of financial professionals, write helpful content, and more.

There's just one important caveat: All content generated should be reviewed before publishing, maintained in books and records, and have review dates based on the risk of the content. For example, information about products, services, or financial advice should be reviewed more regularly.

3. Scale your business with conversational AI

We've already outlined why your business needs to organize your information in a way that can be combined with an AI interface.

Which interfaces exactly? There are more every day, and no organization should limit itself to the technologies of today. That said, there are two present technologies that businesses should prioritize in order to deliver great conversational experiences: chat and search.

At their core, chat and search both enable businesses to provide answers to customers who are looking for information in an interactive way.

But they each excel in different areas — and they can best be used as compliments to each other. In fact, chat needs to rely on a search algorithm in order to find relevant, up-to-date information. (This is why, for example, Bing's chatbot can answer questions about current events while ChatGPT only knows about the world up until 2021.)

Search strengths:

- Search is better for browsing experiences. (For example, you wouldn't want to use chat as the primary interface to your branch/location locator. Those are visual browsing experiences, ideal for search.)

- Search makes it easier to merchandise/hard-code results based on business logic. This is quite difficult to do in chat — though not impossible.

- Search can have UI widgets like facets, filters, sorting, and maps that help your customers navigate content.

- Search is better at personalization with zero-party data. As consumers land on your website and engage in survey-like experiences, based on their responses you can provide a curated list of the most relevant products, people, or content they are looking for.

Chat strengths:

- The user inherently expects chat to be a slower, more conversational experience. A longer anticipated response time means you can use bigger, more powerful models to generate more detailed answers. (For financial services, there are use cases here for support, marketing, and workplace.)

- Chat can take the history of a conversation into account. This means users can ask follow-up questions and dig deep into certain topics. (E.g. chat could help answer a customer's question about a branch they visited last month, or a credit card they asked about previously.)

Chat is capable of summarizing multiple search results to provide an answer. For example, someone could ask "What's the difference between a high-yield savings account versus a money market account?", and chat could tell them the answer by looking at two different documents.

Additionally, many digital experiences in the future are going to blur the line between search and chat, combining the best aspects of both. Many search engines like Bing and Google have already announced new features that combine search and chat into a single interface, allowing users to have a free-flowing conversation about search results. Google’s new Generative Search Experience is a great example: users type in a search query, and Google can synthesize all the results into one easy-to-read answer.

We've written before that the "right" technology to focus on between search and chat is... both. That's truer than ever: there are massive benefits to each that businesses need to start incorporating into their strategy.

Chat is well-suited for informational queries because it returns summarized, easily readable results. Think about someone who wants to know the difference between a Roth IRA and a 401k. Search is still a great channel for high-intent queries from users seeking to take action — like someone who wants to book an appointment with a financial advisor to help them plan for retirement. If the customer wants to engage with your brand, you should give them the experience they desire across any channel they choose.

And businesses can't afford to lose any opportunities to drive engagement based on poor experiences. It's important that they leverage AI to communicate with customers the way they want. (Here's a fun stat: 74% of users say they prefer chat while looking for answers to simple questions.) Embracing conversational AI is critical to gain a competitive advantage.

Curious about Yext Chat? Click here to learn more.

Just like the 90s were the dawn of the web, today is just the beginning for AI. But savvy financial services marketers will embrace AI today to generate content and answer more customer questions.

At the end of the day, AI won't replace marketers — but marketers using AI technology to give their customers what they want will replace those who don't.