The Yext Guide for Marketers in Financial Services: How to Manage Many Digital Channels for Maximum Visibility

The Yext Guide for Marketers in Financial Services: How to Manage Many Digital Channels for Maximum Visibility

A strong digital presence helps you stand out to clients on their financial journey. Learn how marketers use Yext to improve their online visibility.

In every person's life, there are moments when they need to lean on the financial professionals and organizations they trust. Whether they're preparing for marriage, seeking a mortgage to buy a house, or evaluating student loan options to pursue higher education, people turn to financial professionals to help navigate these milestones. These moments are important to consumers, but they're important to you, too: these are your opportunities to prove that they were right to trust you with their business.

As a marketer, you likely aren't writing policies or underwriting loan applications. But you still play a pivotal role in the financial consumers' journey. It's your job to ensure your organization is easily found online — so that people can make informed decisions during these moments of high intent.

Of course, this is easier said than done. There are many different online channels to manage, like your many listings, your website, and even your reviews. Ideally, these channels all share the same information, since consistency is key. But the difficult part is giving all consumers the same information across these various different formats. Still, optimizing these channels is necessary for people to find your organization at the exact moment they're looking for you.

There are several roadblocks that keep marketers from this ideal state. To start, it's difficult to maintain a consistent, cohesive online presence when each channel is managed through a different platform. Instead of focusing on managing each channel, the focus is on maintaining the solutions that manage each channel.

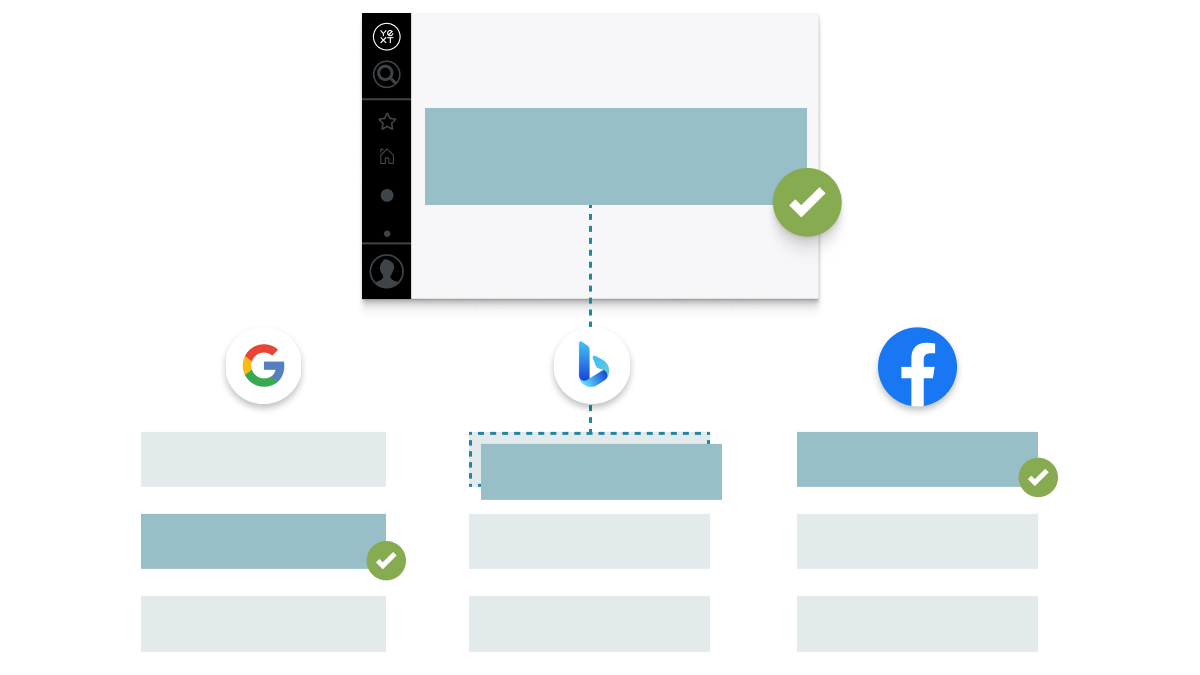

The Yext Platform consolidates your marketing technology, so you can improve your online visibility across a variety of channels. For example, Yext can help you manage your listings, your website, and even the user-generated content that your consumers share about you online, like your reviews. And because these are all separate products, you can mix-and-match Yext products to create a tech stack that works for you. With Yext, you can manage every channel from one platform, resulting in maximum consistency — without overwhelming yourself and your team.

No matter what type of financial services organization you work for, Yext helps consumers find your locations and financial professionals, ensures your information is consistent everywhere, and helps you manage your online reputation. Here's how you can use the Yext platform to drive visibility and consistency so consumers find you, choose you, and continue to trust you with their financial decisions.

How to Use Yext Listings to Drive More Online Visibility & Interactions

When customers have a life milestone that involves a significant financial investment, they turn to digital channels — like Google — to help them make a decision about what financial professionals or organization they trust at this important life moment. This is why it's important that your organization is visible on the search engine results page, or SERP. According to Yext research on financial services trends, 89% of consumers go online to perform research.

When customers have a life milestone that involves a significant financial investment, they turn to digital channels — like Google — to help them make a decision about what financial professionals or organization they trust at this important life moment. This is why it's important that your organization is visible on the search engine results page, or SERP. According to Yext research on financial services trends, 89% of consumers go online to perform research.

Once that consumer makes their initial search, what do they see?

- Your listings. In fact, Yext found that your listings receive 2.7x as many views as your landing pages.

- Your website. There's a lot of information on your listings, including a link to visit your website. Your listings and your website work together to give consumers all the information they need.

- Your reviews. Using Google as an example, the listings review summary will aggregate reviews, and consumers can read individual reviews, too. These reviews help them make a decision on whether your organization is right for their financial needs.

One of your listings is often a potential new consumer's first impression of your organization — and as a marketer, you want to make it a great one. So your listings can't just be visible, they need to be accurate, too.

With Yext Listings, you can reduce the manual effort spent managing dozens of third-party listings. The result? Increased discoverability, consistency across channels, and better ROI on your marketing efforts.

With Yext, you can automate your listings management. Setting up, managing, updating, and analyzing each individual listing manually is time-consuming and painful. And because there are simply so many listings to manage, each new listing creates an exponential increase in your workload. Automating this process with Yext allows you to scale your strategy for maximum impact — and ROI.

Here's how it works:

First, you'll connect your Yext Listings account to any of the 200 publishers that have already partnered with Yext. (Publishers share information about your business and promote your products and services via online business listings.) With Yext, you can manage popular publishers like Google Business Profile, Zillow, Apple Business Connect, and more.

Then, you can use the Listings Verifier to audit your existing listings for accuracy. The Verifier automatically scans the web to determine the accuracy of your listings. This system will continuously sweep your listings over time and flag any inconsistencies in the information, so that you can easily find and update them. Once you've verified all your listings, you can suppress duplicates, so only the brand-approved listings are live.

Pro-tip for wealth advisors and insurance agents: In addition to your organization's listings, you may also need to manage the listings for your advisors and agents. Neglecting this part of your listings management strategy can result in duplicate listings, as well as listings with outdated information — think of an advisor who has moved firms, but their leads are being sent to their old firm. Use the Listings Verifier and Duplicate Suppression features to mitigate these concerns. And when it comes to managing listings for individuals, consumers will be interested in information beyond the standard location and contact information. They may want to know if this professional speaks a secondary language like Spanish, or specializes in something specific, like saving for college. Be sure to include the information that sets each individual apart — it might be exactly what your consumers need to know to convert.

You are able to manage each publisher for each listing within Yext Listings, replacing dozens of separate logins with just one comprehensive solution. Simply update your information for a listing in one field, and then sync that update across all the publishers your listings appear on. This helps you keep your information consistent across each listing, and significantly reduces the effort spent managing each publisher — effectively mitigating two of the greatest challenges marketers face when it comes to driving new business via listings.

Pro-tip for financial institutions: Your listings are your branch locations and your mortgage loan officers. Branches with complete, optimized listings receive 52% more clicks from local search. Your listings management strategy needs to take into account all the information customers need to find your branches. This includes your physical location, hours of operation, and whether you have an ATM.

Sometimes, you may receive "suggested updates" to your listings. These can be proposed edits from publishers, consumers, your employees, or even the Yext platform itself. To manage these, you can use the Yext Listings Suggestions feature to view, approve, or deny any proposed edits from across all sources, all in one place.

Finally, use Listings Analytics to learn more about the way your consumers want to engage with your business. Then, you can optimize your listings management strategy to increase your online visibility. Your analytics will reveal how many impressions your listings receive, identify what keywords bring you the most traffic, and track which CTAs drive the most conversions.

How to Use Yext Site Search on Your Website to Engage Consumers

Your listings might receive more views than your landing pages, but once consumers visit your site, they're engaging with your brand on an owned channel. Now, their intent is higher — and so are their expectations. Your website needs to host all the information a consumer might need, and that information needs to be easily accessible, too.

Your listings might receive more views than your landing pages, but once consumers visit your site, they're engaging with your brand on an owned channel. Now, their intent is higher — and so are their expectations. Your website needs to host all the information a consumer might need, and that information needs to be easily accessible, too.

Think about what consumers might want to do on your website:

- To learn. They see your organization as a trustworthy source of information on topics, like how much insurance to carry or whether a money market account is right for their financial plan. They can do their own research by reading your blogs, FAQs, and customer stories.

- To self-serve. Some studies find that 69% of consumers will try to troubleshoot issues themselves. Your consumers may turn to your website for troubleshooting help. If they do, they'll expect to find information that helps them to help themselves.

- To plan their next steps. Think back to the moments a consumer relies on your organization for help. For example, when someone has just been married, they may need guidance on how to set up a joint account, or how to update the beneficiaries on their life insurance policy. They're turning to your organization for help figuring out what they need to do next.

This information might all be accessible through a few clicks in your navigation menu and by reading landing pages. But unfortunately, the more clicks a user needs to make, the more likely they are to end their journey on your site and turn somewhere else for information — like a competitor. That's why site search is a helpful tool for engaging consumers as they take the next step in their journey, whatever it may be.

The benefit of an organized website with reliable information and an easy-to-use search experience is clear: consumers find what they need quickly and easily, which increases their satisfaction with your organization.

But the reason why marketers struggle to deliver this experience is clear, too. Their website hosts a lot of information, and it only grows over time as new landing pages and content are produced. And with every new blog, existing content becomes harder to find even when a consumer is actively looking for it.

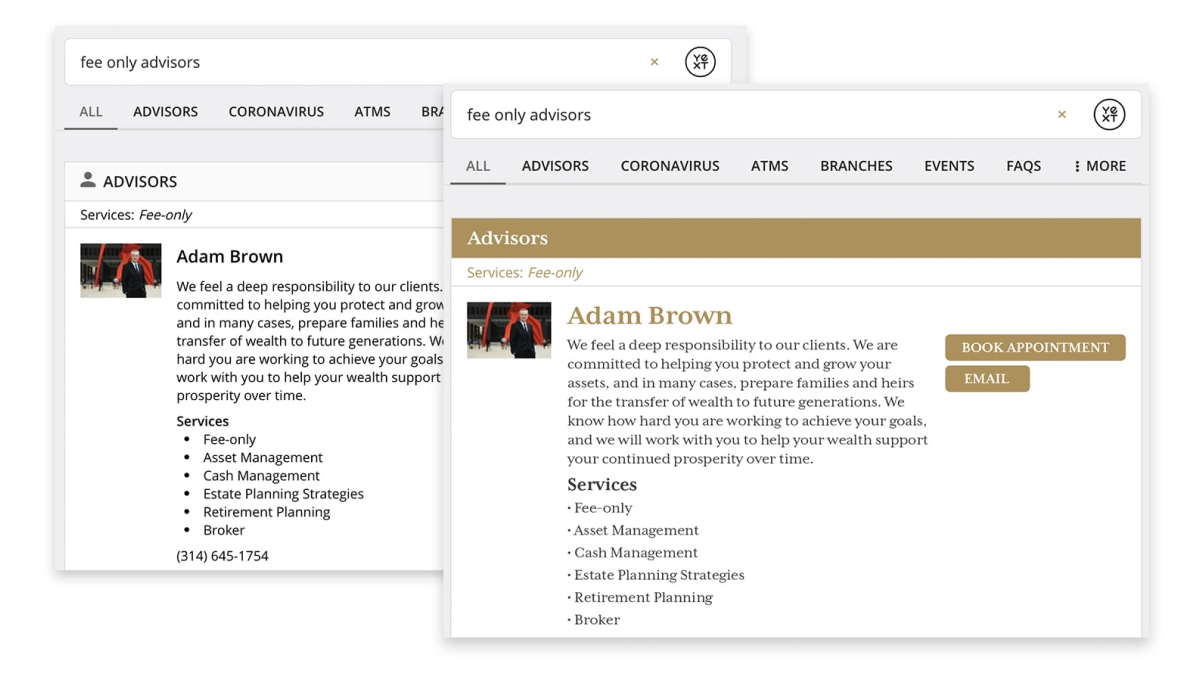

With Yext Search, you can provide accurate answers that directly reference your organizations' most up-to-date information. Yext Search uses modern search technology like natural language search and semantic understanding to match a consumer's search query with the most relevant results. With Yext, your consumers find the right answers faster — and it's simple for your team to set up.

Here's how it works:

First, use the Directory Manager to structure all your information and content in an easy-to-understand hierarchy. From here, you'll be able to model relationships between your information. For faster time-to-value, you can use Yext's predefined models for financial services, which includes templates for insurance agents, wealth advisors, mortgage loan officers, and more. For example, you can associate help articles with a particular product or service, or associate contact information with specific branches or locations.

Pro-tip for financial institutions: When it comes to banking, consumers overwhelmingly prefer to self-serve. Make sure your help site information is searchable via your search bar, so customers can troubleshoot and self-serve themselves.

Then, you'll need to make an important decision on user experience. Decide whether you want to use a pre-configured search experience template or design a custom search experience. Both are options with Yext, but with search templates you can set up your search experience more quickly and easily. Afterwards, you only need to add the search navigation bar to your website.

And that's it — now, your website has a search experience that makes it easier than ever to deliver all kinds of information to your consumers.

Pro-tip for insurance agencies and brokerages: Experiencing a claim event can be jarring for consumers. When they turn to your website during times of high stress, make sure that you have helpful information readily available and searchable, like "how to file a claim" and "[insurance carrier] claim phone number."

Immediately after you've installed Yext Search, you can start to analyze your users' search data. The Search Terms Analysis & Clustering feature will help you understand what searches are most popular among your consumers, and help you optimize the search algorithm. By collecting and analyzing this zero-party data, you can learn more about your consumers' intent, and how you can better serve them.

The key to a great search experience is well-managed information for the algorithm to draw from. With Yext Search, you can surface all your structured information quickly — and with little manual effort, compared to creating a site search experience from scratch. No matter what stage the consumer is at in their journey, Yext Search makes sure the information on your site is easily found during moments of high intent.

How to Use Yext Reviews to Increase Your Online Discoverability and Conversions

Reviews bring the consumer's journey full circle. They consulted past consumer reviews to make their decision, and now they're leaving a review of their own to help others do the same. You don't have to guess whether new consumers read your reviews, either: 80% of prospects find reviews important to the financial consumer journey.

Reviews bring the consumer's journey full circle. They consulted past consumer reviews to make their decision, and now they're leaving a review of their own to help others do the same. You don't have to guess whether new consumers read your reviews, either: 80% of prospects find reviews important to the financial consumer journey.

And, in our own Yext research, we found that financial professionals and branches with 4-5 stars have a 45% improvement in search engine ranking. Additionally, they see a 15% increase in phone calls and an 18% improvement in website clicks. Reviews have also been shown to produce an average 18% uplift in sales. In short, reviews help consumers find and choose your organization.

You want to make it as easy as possible for a consumer who had a great experience to share that online. You also want to make it as easy as possible for potential new consumers to see that others have had a great experience with your organization. And consider this: Yext financial services and insurance customers that generate first-party reviews are rated 1.1 stars higher than those that don't. This is why it's so important to generate and manage your reviews.

Sometimes, you'll also receive reviews that indicate a consumer didn't have an ideal experience. This might be dismaying at first, but it's an opportunity to learn from that consumer's experience, examine the process that may have broken, and optimize that part of the journey. And by responding to that review with empathy, you show new potential consumers that you take feedback seriously. Additionally, Yext customers that respond to reviews are rated .36 stars higher than those that don't.

A note on reviews and industry regulations

Financial services is a highly regulated industry, and sometimes the (valid) fear of violating any SEC regulations keeps financial institutions and insurers from implementing a proactive reputation management strategy. But the SEC Marketing Rule was amended on Dec 20, 2020, and as of Nov 4, 2022, the SEC is enforcing it, too.

You can now partake in these four key pillars of a rep management strategy while staying compliant with the SEC:

- Review monitoring

- Review generation

- Review response

- Review marketing

To learn more about how you can implement a reputation management strategy and stay compliant with federal guidelines, watch this webinar Yext hosted with Conway Dodge, Deputy Head of the Americas & Head of Compliance at Promontory, a Business Unit of IBM Consulting and Former Assistant Director in the SEC's Division of Enforcement, and Michael Vorhis, Director at Promontory, a Business Unit of IBM Consulting. Here, these industry experts dive into how you can navigate the new SEC Marketing Rule to deliver personalized experiences, leverage tech like AI, and ultimately achieve business growth. Watch on-demand now.

Here's how it works:

First, you'll decide which review platforms you want to manage. Examples of popular platforms are Google Reviews and Yelp. Then, you'll connect each managed review platform to the Yext Reviews solution. This will aggregate all your reviews as they're made in real-time into one place for easy management. Then, you may want to create labels so you can categorize your reviews.

Pro-tip for financial institutions: You may want to create labels for your MLOs, individual branch locations, and/or products. This helps you sort reviews into these categories, and monitor changes over time.

Pro-tip for financial advisors: You may want to create labels for your advisors, your office locations, and/or your products/services offered. Then, you can see which advisors, locations, and/or products and services are favored by consumers.

Pro-tip for insurance agents: You may want to create labels for your agents, your office locations, your products offered (personal insurance, commercial insurance, life insurance, etc.), and what the consumer needed (i.e., getting quotes or making a claim). If you are an independent brokerage, you may also want to label reviews by the consumer's carrier (i.e., Travelers, Allstate, etc.). This will help you understand consumers' experiences from different lenses, and can lead to important insights, like whether a carrier's poor claims services reflect poorly on your brokerage.

Once you have synced your review platforms with Yext Reviews, set up notifications so you are notified every time a new review is made. This will help you respond as quickly as possible. Alternatively, you can designate a certain time of day or week to respond to all your new reviews. Yext Reviews also has a Sentiment Analysis feature, so you can sort and prioritize reviews based on whether the consumer had a great experience, or a poor one.

Finally, you can jump into your ongoing reputation management strategy by responding to each and every review. We recommend focusing on new reviews as they come in; only start responding to reviews in your backlog if you have caught up on responding to recent reviews. And make sure to manage and respond to reviews with photos, too.

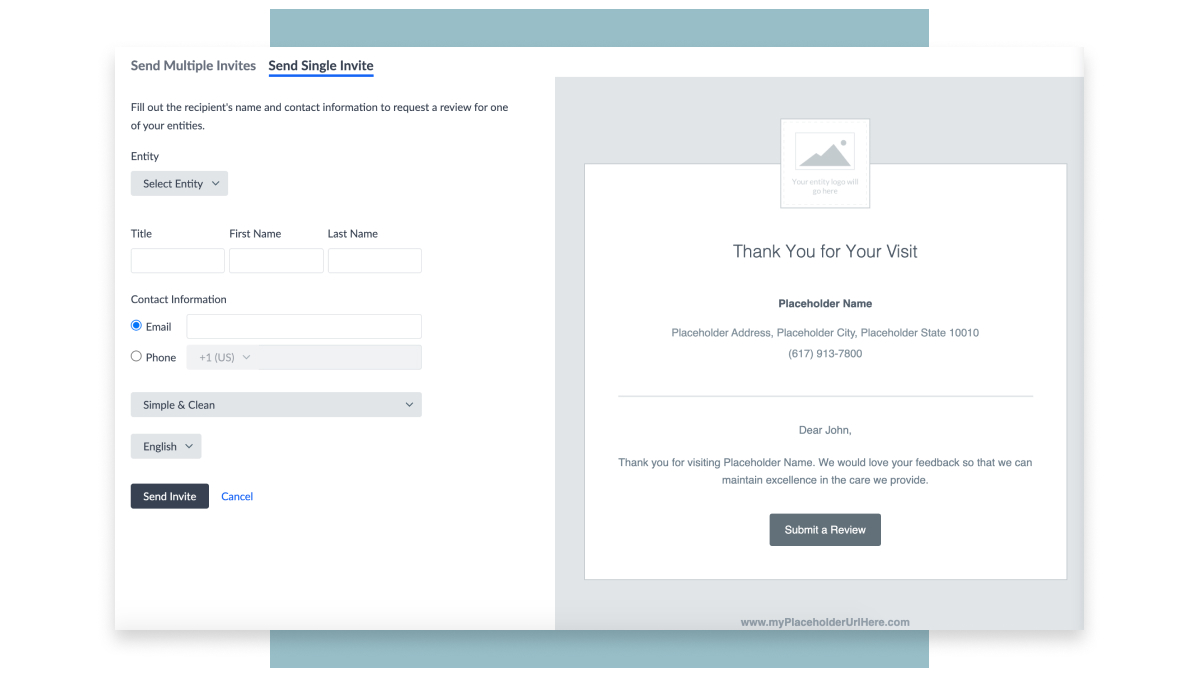

Once you have a strategy in place for responding to reviews, you can solicit them, too. Under the new SEC Marketing Rule, financial institutions, advisors, and insurers can generate reviews and use them in marketing efforts.

Yext Reviews helps you generate first-party reviews on your financial professionals. This helps you win more business, while still adhering to financial services and insurance regulations, like the SEC, FINRA, CFPB, and more. Within the Yext platform, you can request reviews on financial professionals from consumers. Then, you can add those reviews to your website and landing pages to increase conversions.

Finally, be sure to monitor your reviews for trends over time. This will help you gain insights on your consumers' journeys, directly from your consumers, and without leaving the Yext platform.. Is any one financial professional performing above average? What about below? What can you learn from these reviews, and how can you use this information to improve your customers' experiences?

Reviews are valuable sources of zero-party data — be sure to maximize how you use them. And beyond the insights you gain from hearing directly from consumers, you'll also see higher ranking in the SERP and more interactions on your listings.

Conclusion

Your listings, your website, and your reviews each play an important role in the financial consumer's journey. Your job as a marketer is to make sure that all these channels work together to give consumers a consistent, accurate representation of your organization, all throughout their online journey.

And just like these channels work together to give consumers a great impression of your organization online, Listings, Search, and Reviews converge in the Yext platform so your experience as a marketer is great, too.

With Yext, you can increase your online visibility and deliver consistent information across channels — and you can do it all in one platform.